Getting Started With Bitcoin And CryptoCurrencies, A Beginner's Guide

As Bitcoin is going mainstream, it’s not seen anymore as an oddity reserved for geeks. However, the world of cryptocurrencies is still surrounded by a mystery halo and lots of doubts for the non-tech savvy. In this article, you will find a guide for getting started with Bitcoin and cryptocurrencies, intended for people who don’t have a technical background.

Obviously, Bitcoin and cryptocurrencies are complex topics with hundreds of books devoted to them. Hence, this post doesn’t try to cover all the specific details but offer a complete overview of all aspects you need to know before joining this digital revolution.

Let’s start!

Why Cryptocurrencies?

If you are reading this, you’ve probably heard about Bitcoin. There’s a lot of information out there. So much, in fact, that can be overwhelming. Apart from the buzz, what’s the point -if any- of owning Bitcoin, Litecoin or Ethereum?

I think cryptocurrencies are here to stay and will grow to become the currency of the future. However, you need to be aware that they are currently a risky investment. Not something you “need to get into”, but something you “can get into” if you understand the risks.

Let me enumerate the main pros and cons you have to keep in mind when deciding whether or not investing in cryptocurrencies.

Cons

The main con is the volatile nature of cryptocurrencies. You should think of investing some money here as equivalent to investing in the stock market. Actually, Bitcoin price is more volatile than any Wall Street stock. Recently, its price got to almost $20k before falling dramatically to less than half its value.

In the long run, the price may rally and recover its value. But if you see it as an investment, you need to understand this as a long-term one. Cryptocurrencies and Bitcoin are not for the faint-hearted.

Also, as with any other type of investment, you need to take care of keeping it secure. That implies some kind of knowledge about what a wallet is, where to store it, etc. More about that below.

Pros

First of all, Bitcoin and other alt-coins are perfect solutions for digital nomads. They are another great alternative to traditional banking. They are not subject to taxes, scrutiny or constraints from traditional banks.

While there are been attempts to clamp down or regulate cryptocurrencies, their design makes them resilient to control attempts from a centralized entity or government.

Their price and value are the same regardless of where you travel. It’s not determined by any third party, just the market, and the technology. As long as you have an internet connection, you can operate with them.

Next, they can be a great long-term investment. Also, if you spend some time and do your research, you can earn some money by trading cryptocurrencies. There are actually people making a living out there as traders.

Finally, in my humble opinion, cryptocurrencies are the future. There are even countries -like Estonia- that are considering their own coins. I believe that, in 50 years, nobody will be using fiat currency as we know it today.

So let’s do a quick recap of everything you need to know before getting into Bitcoin and cryptocurrencies.

Basic Concepts

Bitcoin was the first cryptocurrency. It was created by the end of 2008 by a mysterious person under the name -real or not- of Satoshi Nakamoto. While currently the most popular and widespread one, it’s not the only cryptocurrency. There are a number of different alt-coins out there. The most well-known ones are Ethereum, Litecoin, Bitcoin Cash, Monero, and Dash, to name a few.

Their underlying technology is called a blockchain.

But what is a blockchain? Ok, take a deep breath, I promise I won’t go too technical here.

A blockchain is a public ledger shared within a peer to peer network (like the ones made popular in the 90’s by BitTorrent platforms such as Napster). You can think of this ledger as a list of blocks that get added securely to the chain. These blocks contain -among other things- transactions from sender A to recipient B. All nodes in the peer to peer network agree that one chain is the “correct” one by means of a consensus algorithm.

Transactions And Mining For The Non-Tech Savvy

How blocks -and hence, transactions- are added to the ledger?

They are generated by miners -software programs, usually running on top of a powerful hardware-. These miners collect all the transaction requests from the network and generate a block. Then, to add it to the blockchain, they need to “mine” it. Usually, mining involves solving a mathematical puzzle of some kind. This is called “proof of work”, because it requires a non-trivial set of calculation and, thus, computational power.

This “proof of work” ensures that the first miner that solves the puzzle will add the block to the chain -getting some coins as a reward- and spread it across the network

But why?

Imagine that anybody could add blocks to the chain without this process. You could be able to spend the same money multiple times, so building a currency system would be impossible.

While other ways have been proposed for reaching this consensus (Ethereum and its “proof of stake” probably being the most popular), most blockchains currently use proof of work.

Where Is My Money Stored?

Your money is not “stored” anywhere. Every participant -i.e: you– in a blockchain has a public and a private key. They are related so that the public one is used by someone to send you money, and the private one is used by you to send money to other public addresses. You can think of the public key as your bank account’s IBAN and the private key as your PIN number.

All transactions -except for some alt-coins like Monero- are public. Thus, by following the record of transactions from the very first block to the last one, everybody can “calculate” how many coins a concrete account owns.

Then, there are software programs called “wallets” that take care of securely storing your keys. I talk in depth about what wallets are and how to choose the best Bitcoin wallet here.

What’s The Price Of Bitcoin?

Another confusing aspect for those getting started with Bitcoin -or other cryptocurrencies- is its price. The price of a fiat currency like the US dollar is determined by a centralized entity -like the US government- and its trade in the foreign exchange markets.

However, there’s no central entity controlling Bitcoin. Its price is determined by supply and demand.

As a result, while the price of the US dollar is affected by fluctuations in the US economy and subsequent decisions of the US government, the price of Bitcoin is affected by technological aspects (such as new features) and news affecting its adoption (i.e: if China decides to ban Bitcoin mining). Contrarily to fiat currencies, the price of cryptocurrencies fluctuates rapidly and sometimes dramatically.

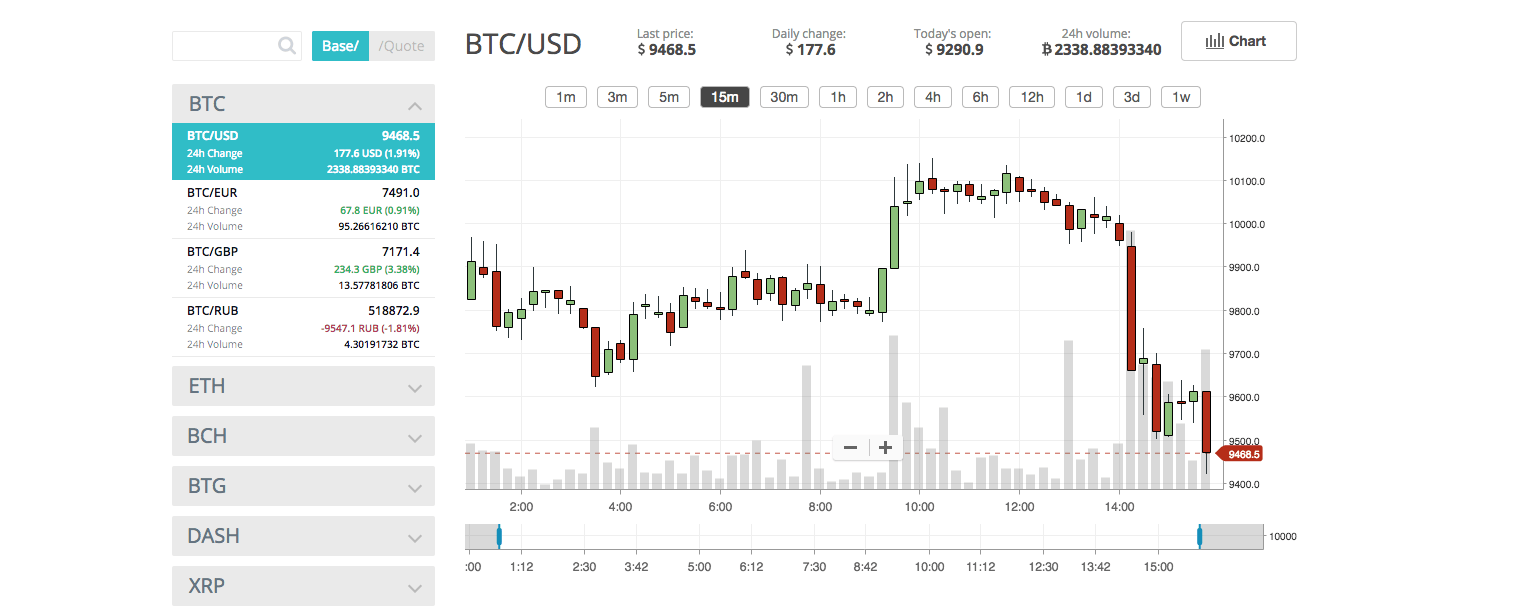

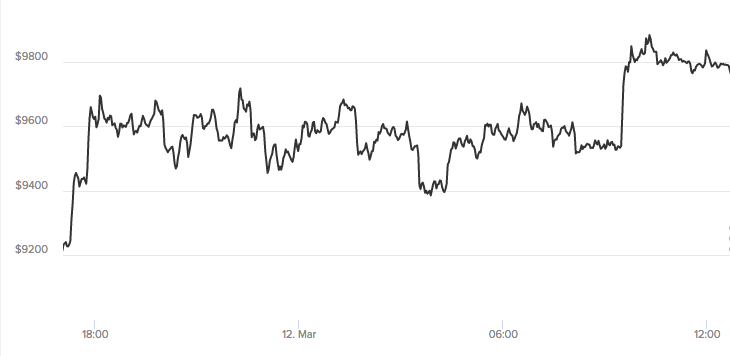

There are two ways in which prices for cryptocurrencies are represented: single graphs and candlestick graphs.

The former is just a single line graph with the closing price (its final value) for a given period.

Candlestick graphs offer much more information. They show green and red bars. A green one indicates a price increase at that given period, and the start and end values are the bottom and top of the bar respectively. Conversely, red bars indicate a price decrease.

As you can see, this graph allows you to see the behavior of the currency in more detail.

Getting Started With Bitcoin And Other Cryptocurrencies

To begin with, you need to get your hands on some coins. Which ones? I would suggest you Bitcoin or Ethereum. There are many ways of doing that, but the easiest ones are exchanges and the Revolut card.

Exchanges

Exchanges are websites where you can trade between fiat and cryptocurrencies. There are many exchanges out there: Bittrex, CEX.io, Poloniex, Kraken…

For beginners, I would recommend CEX.io, just because it’s the one offering a more friendly, easy to use interface. That makes it harder to do some fatal mistake as a novice user and send your money to Kazakhstan.

Usually, the process goes as follows. First, you sign up to the site. Depending on the exchange, you will need to give some personal information or not. Some exchanges apply limitations to the amount of money you can get in or out depending on the documents you have provided to identify yourself. Unless you are a delinquent, there’s nothing to fear here.

Then, you need to “top up” your balance with some fiat money (i.e: euros). In order to do that, you do a wire transfer or credit card payment to a specific account. I recommend bank transfers because the fees for credit cards are usually higher. Conversely, card payments are almost immediate, so if you are in a hurry to get the perfect Bitcoin exchange rate, it’s an option to consider.

It may take some time for your funds to appear in your balance. Then, once they arrive, you need to trade your money for coins by placing an order.

Placing Your First Order

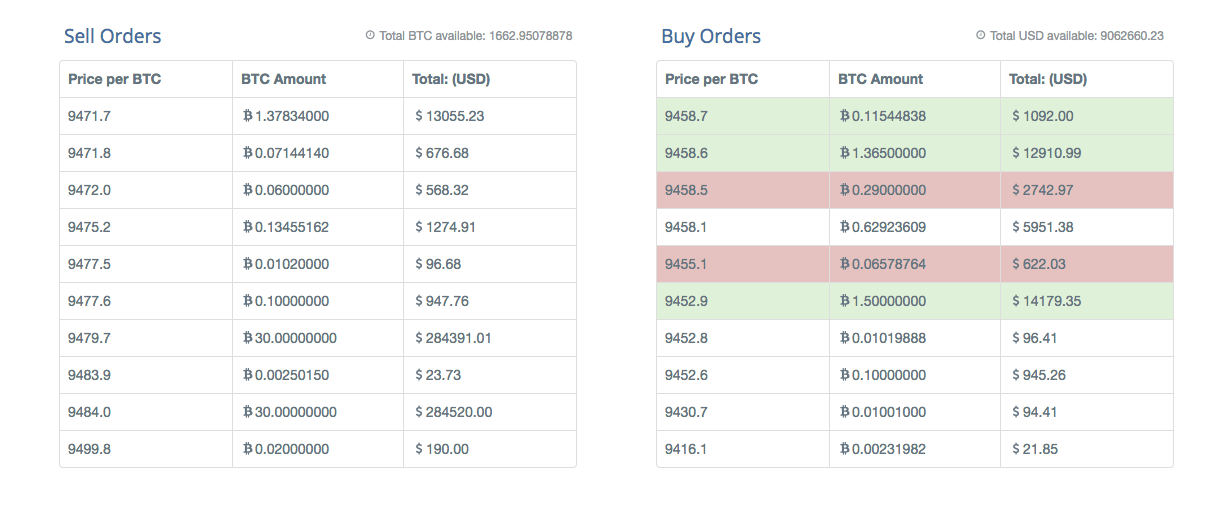

There are two types of orders: buying orders (i.e: you want to buy Bitcoin in exchange for your euros) and selling orders (i.e: you want to sell Bitcoin to get euros).

Now it may be clearer why there’s no “single” value for Bitcoin. Each exchange has people willing to buy or sell them. The average price of Bitcoin at that exchange, then, is calculated as the average of the supply and demand prices that are being offered. This, in turn, affects the prices of new orders being placed.

That’s the reason why the price of Bitcoin varies slightly between different exchanges.

You need to take the current price into consideration when placing your order. Remember that buying orders will usually look for a lower price (you want more Bitcoin for your dollars) and vice-versa.

When you are about to place your order, it’s better to have a look at the ones already there and set your price somewhere between the 2nd and 5th positions. That way, you will get a good starting price while not waiting too long for someone to accept the order.

As an example, the figure above shows the buying and selling orders for a BTC/USD price of $9462.4. If you want to buy Bitcoin, a good starting price would be 9458.5.

Next, you need to wait until someone accepts your offer. Take into account that an abrupt price change can cause your order to never complete -because it’s no longer appealing- or to be such a bargain that you would get a lot less for your money. In our example, if the price suddenly drops to $8500/BTC, nobody is going to accept your offer. It takes some practice to learn how the market works.

The Revolut Card

Another way, probably the easiest one, of getting Bitcoin or other cryptocurrencies is the Revolut card. I have talked about this card when I discussed digital banking alternatives for digital nomads.

Another way, probably the easiest one, of getting Bitcoin or other cryptocurrencies is the Revolut card. I have talked about this card when I discussed digital banking alternatives for digital nomads.

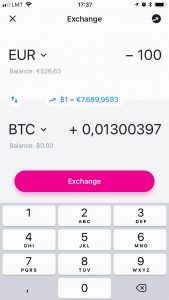

Recently, Revolut introduced cryptocurrency exchange. You can now create a cryptocurrency -Bitcoin, Ethereum or Litecoin- account and top it up with money from one of your other accounts.

Its main pro is how easy it is to get started when compared to the exchange process. You just enter the Revolut App, click on More > Cryptocurrencies, and bam! you can instantly exchange 100€ for Bitcoin. No hassle, fast and super easy.

The cons are basically two. First, the exchange rates are controlled exclusively by Revolut, instead of the market, and secondly, that -right now- you cannot get your Bitcoin out to another wallet or top up your account with Bitcoin from an outside address. You can only transfer the cryptocurrencies within Revolut accounts. Still, the easiest and fastest option to get started.

Other places

There are other places like Local Bitcoins that allow you to exchange Bitcoin directly from people nearby. Also, most important cities have online groups and communities of traders. These are just the most well-known options, of course. You can even get Bitcoin using things like a Telegram bot nowadays. However, if you are a beginner it’s better and safer to stick to the methods I mentioned above. Your money will be more secure.

How Much Money Should I Invest?

That depends on your goals and, of course, on your budget.

If your plan is getting started with Bitcoin or getting to know how cryptocurrencies work, a small amount (100-200€) is enough. If you consider it an investment, it would be interesting to get at least 1000-2000€ worth of Bitcoin or Ethereum.

Remember, nonetheless, about the volatility of this market. Don’t invest here money that you really need.

What’s Next?

Ok, You’ve got some Bitcoin, so now what? Well, there are some things you can do right now with it.

Purchasing Stuff

There are lots of things that can be bought with cryptocurrencies. While it will take some time until your supermarket accepts Ethereum payments, there are many places where Bitcoin is accepted. These are just some examples:

- Travel: AirBaltic allows you to pay with Bitcoin. I have already tried it and works flawlessly.

- Buy furniture, clothing or jewelry at Overstock.

- Pay the hosting and domain for your servers. If you have a blog, you can pay the hosting with Bitcoin.

- Rent a house: I spotted a house in AirBnB the other day in Jurmala (the beach close to Riga, Latvia) where the owner accepted Bitcoin payments.

- Buy anything from a Shopify online shop, including physical goods.

- Buy games, apps or movies at the Windows and Xbox stores.

- … and A LOT more.

Trading

Believe it or not, there are a lot of people making a living out of trading. The principles are similar to the stocks market, only applied to cryptocurrencies. You buy when the price is low and sell when the price is high. Also, the idea is considering different altcoins and evaluating their prices to move your funds from one to the other at the right moment.

However, it’s a risky occupation and takes a lot of time and practice until you are good at it. Along the way, you can -and probably will- lose some money. Talking about trading in depth would, again, require a whole book, so I will probably devote a whole post to this subject in the future.

Investing

Also, you can hold your crypto assets hoping that the price will rise. Apart from some Bitcoin, I mined back in the early 2010’s, when I did my first Bitcoin purchase, its price was roughly $1000. While it plummeted soon thereafter, it reached almost $20k by the end of 2017. No wonder why more and more people are considering it as a long-term investment.

Mining

When I started to mine as a hobby, almost ten years ago, you could actually mine Bitcoin with a crappy PC. This is no longer true. Bitcoin and most other altcoins have been designed so that the mining difficulty increases over time.

That means that today, you need to buy specialized equipment (called an ASIC in the case of Bitcoin) and join a network of miners working together to get some real chances of earning money. These machines consume huge amounts of energy, so electricity costs are an important factor to take into account too.

Mining is another hot topic that is beyond the scope of this article. I will write about it in a future post.

Conclusion

In this article, you will find a complete beginner’s guide for getting started with Bitcoin and cryptocurrencies in general. It’s intended for non-IT people with little to no knowledge on the subject.

I tried to offer a simple but exhaustive overview of what Bitcoin and other alt-coins are, how to get your first Bitcoin or Ethereum, and what to do with it.

Comments ()