Why losing 130,000€ made me the happiest man alive (Part 1)

Finally, I was able to get rid of my house and the associated mortgage and account in Spain. I’m a free man now. However, this catharsis has come at a price. Concretely, 130,000€. That’s the money I’ve lost, all things considered, as a result of buying my house in Spain more than 13 years ago.

In this blog post series, I want to share why I decided to sell my house, knowing that I would lose a lot of money, describe my journey, and explain why this was one of the most liberating moments of my life. I also want to share how selling now, even when it meant losing 130,000€, may have been one of the best financial moves I’ve ever done, one I should have made a long time ago.

Wait, 130,000€? Are you mad?

Yep! I will get into the ins and outs later, but before that, let me give you some background on why I bought my house, which turned out to be the biggest mistake of my life.

Let’s go back in time to February 2008. A young guy with a promising academic career in ML was working at the University Of Murcia and desperately trying to buy a house. This stupid guy (spoiler, that was me) thought his whole life would revolve around the university. He would work his ass off to finish his Ph. D, become a teacher at the university, and secure a rewarding position as an AI researcher and professor.

How naïve.

Life had different plans for this guy. However, he was completely unaware of that at the time. And in 2008, there was this real estate frenzy in Spain. It seemed like everybody was eager to buy a house. Prices had been going up for years, and the family of our friend, his friends, colleagues, teammates… all of them were saying: “You are throwing money down the drain!”, “You need to buy a house now!”, “Prices are going up, so the more you wait the more expensive it’s going to be”, and (my favorite) “This is a safe investment, house prices are NEVER going to fall”.

So I bought a house. I married the bank. I acquired a mortgage. Soon after, I grown disenchanted with the research scene and moved to Madrid and, some years later, I became a nomad and founded a business that’s taken me to most corners of the world.

That house was always there, in my mind, a bleak reminder of my past mistakes, of how stupid I had been.

It took me a little more than twelve years to get rid of it.

Selling that f****r

Years later, that guy had fortunately learned a few things about finance and was better prepared to do more educated decisions in his life. He opened a business and, after a couple of years, he was able to reap the rewards of his hard work in the form of dividends. Enough to pay for the remaining mortgage, which was slightly more than 95,000€ down from the initial amount of 138,000€.

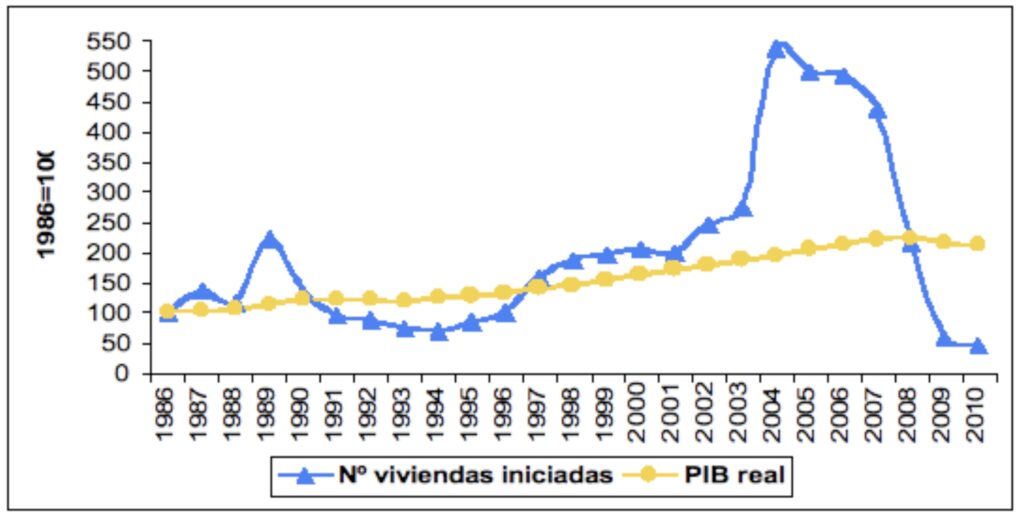

The real estate bubble was devastating for Spain, but especially for his little corner of the world. During seven years, from 2001 to 2008, the number of new houses in Murcia (my home region) multiplied by five, while the real GDP barely doubled. The graph below clearly depicts the real estate bubble in all of its exploding glory.

By 2009, there were literally dozens of thousands of uninhabited houses in Murcia. Prices fell so dramatically that our guy would have been lucky to sell his house for a quarter of the mortgage’s value back then, leaving him with no house and more than 100,000€ in debt. So much for “safe investments”…

More than twelve years later, house prices were still so low that our friend calculated he would be able to sell his house for 70-75k at most. That didn’t look like a bargain.

People still insisted that I should hang on to it. “Prices will eventually recover”, “Don’t mis-sell it”. I decided to ignore everybody and sell it anyway. As I will explain later, I thought (and I still think) that selling was the smartest decision from a financial point of view. But I actually didn’t care about the numbers, I f*****g needed to sell that f****r.

I love it when a plan comes together…

And thus, my tortuous journey to sell the house started. The plan was simple:

First, I would distribute 95k in dividends, enough to cancel the mortgage.

Then, without a mortgage to care about, I would be free to list the house at an appealing price to ensure a fast sale.

Next, once the house was sold, I would invest any money left to reverse the situation I’d been enduring for all these years. The goal was to put my money to work to earn money every month instead of losing it.

Finally, I would close the bank account associated with the mortgage and cut ties with Spain, traditional banks, and real estate for good.

There were many dark clouds on the horizon, though. I am no longer a stupid 20-something boy, so I wanted to do things right. The most important problem is, I am a nomad, and I knew that would mean issues with the bank and the tax office. As I’ve described before, the world’s not ready for digital nomads yet, especially outdated institutions such as banks and governments.

I decided to get a lawyer.

He told me that it was not possible to receive the money of the sale in a “foreign” bank account (that, fortunately, turned out to be untrue). I knew the bank would ask me for my tax residence as soon as I tried to cancel my mortgage and would block my account as soon as I received the money from the buyer. I also knew they would not even understand the concept of digital nomadism, and would think I was laundering money or doing some criminal activity. I had gone through all of that when I closed my other bank accounts after leaving Spain.

Hiring a lawyer and the Power of Attorney

Spain is not Estonia. One does not simply do these things online. Thus, I had to get a lawyer. He would be in charge of completing the sale, go to the notary and execute all the required procedures, and then close my bank account in Spain. That implied of course granting him a power of attorney to do all these things.

Doing the process through the embassy implied a shamefully long process involving the consul (who happened to have a busy schedule and a one-month vacation period coming up soon, which means I would have waited for probably two months or more).

Luckily, I had to do a short visit to Spain. It was the perfect opportunity to visit a notary and get the power of attorney. After years of managing my business online, the process seemed like going back to medieval times. It’s easy to forget how cumbersome, pompous and anachronistic these procedures are, the notary office, the ridiculously pretentious staging, the red tape… When I left the notary’s office, I promised myself not to do anything that would require me to visit such an office again.

The funniest moment was when the notary saw the power of attorney. She raised an eyebrow and said: “Are you aware of the fact that this person will be able to sell any real estate property and close any bank account in your name in Spain?” I smiled and said: “yes, that’s exactly the plan”.

Ready? Steady? Go!

With my lawyer by my side, all those paranoid precautions, and a carefully crafted plan to avoid any trouble with the bank, I was ready to start a frictionless process… Or so I thought. As you would expect, it was the beginning of a nightmarish journey that took me months to complete and caused me a lot of stress and costs.

I had the feeling that this blog post would be too long for reading it from A to Z, so I decided to divide it in three parts to make it more accessible (and less boring).

In part 2, I will talk about all the problems I experienced trying to cancel my mortgage at the bank. Something that you would expect to be a simple process once you have the money, right?

In part 3, I will explain why I believe selling the house was the best possible financial decision, even if the logic initially would seem to indicate the contrary, and offer some numbers to support that belief.

What do you think about all of this so far? Let me know in the comments!

Comments ()