Mintos VS PeerBerry: My Personal Experience.

There are many reviews of Mintos VS Peerberry (and others) written out there, but most of them seem to be written by algorithms or P2P review sites, not real users (or even people). Hence, I decided to write my own review.

I will write about them from a personal point of view, based on my own experiences as a small investor, and after going through situations such as the COVID pandemic and the Russian invasion of Ukraine. I will also use a very simple, layman language. If you are looking for technical reviews or detailed stats about the number of loan originators, investor base, or average return of investment, it’s as simple as looking for ”mintos vs peerberry” on Google 😉.

Are you ready? Let’s do this!

The Skin In The Game

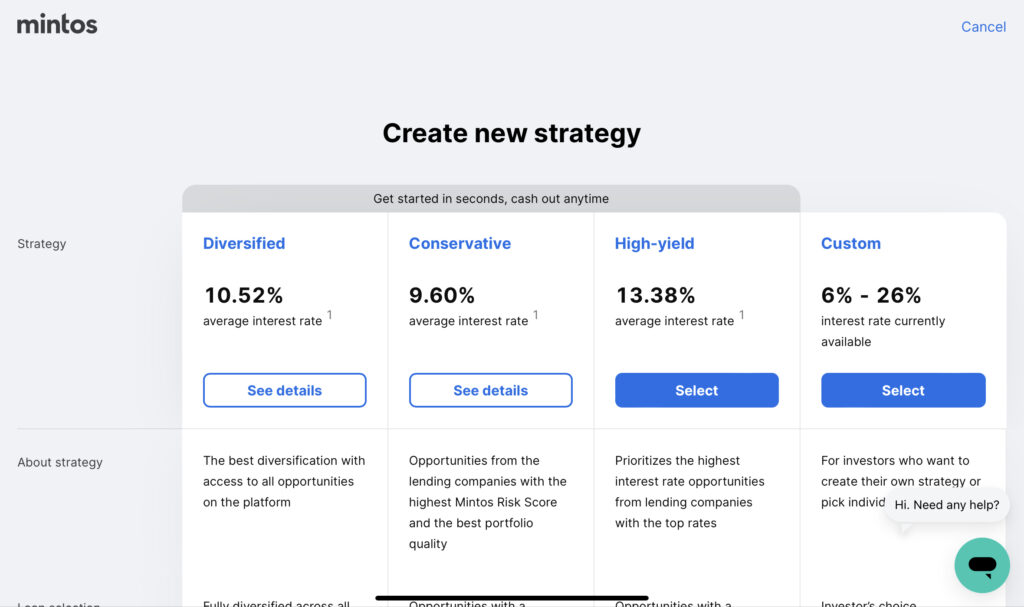

I am not a risk-taker. Not, at least, when it comes to my savings. In Mintos, I chose a conservative strategy. As we will see later, there are different strategies you can use that will yield different results and expose you to different levels of risk. Also, as I will explain, the conservative strategy of Mintos is not conservative at all.

PeerBerry does not have this distinction between conservative or non-conservative strategies, but it offers more security by default and more options to filter out riskier investments from your portfolio without having to manually choose every single loan.

Brief Intro Of P2P Lending Platforms, Mintos and PeerBerry

P2P lending platforms are investment platforms that allow anyone to finance loans. Depending on the platform, you can invest in different types of loans, including personal, business, real estate, or car loans. Simply put, you give your money to a lending company that will lend it to an individual or business, and get a ROI based on the loan’s terms.

You can choose specific loans to invest in, or set auto investment strategies that will select the loans automatically based on a certain criteria. Automatic investment strategies allow you to reinvest automatically both the capital and earned interest once the loan has finished.

Mintos was founded in 2015 in Latvia and has positioned itself as the leading P2P platform. It has the largest number of loan originators and loan volume. PeerBerry was founded two years later, and has been growing quite fast.

Both platforms are largely similar in terms of functionality. What matters to me (and I guess to many other investors out there) are things such as how reliable they are, the real ROI you can expect from them, how good is their customer support, how easy it is to use their interface, etc. Let’s dive in.

Interface

Both platforms offer web interfaces and mobile apps. The Mintos application has a lot more options and can be more satisfying for pro users. I personally find it more complex and confusing. PeerBerry, on the contrary, has a simpler interface, but much more satisfying.

Interestingly, Mintos mobile app shows a very nice, simplified overview of your current portfolio, including net profits month over month. This information, which I find so useful, is not included in the web interface.

As a result, I find myself switching back and forth between the app (when I need to consult information) and the web (when I need more detailed data or want to invest or modify my portfolio settings.

The PeerBerry application has the same information on both the app and the web interface, so you can see at a glance the current situation of your portfolio.

Investment options

Both platforms allow you to invest in selected loans (applying your selection criteria based on a rich set of filters) and also offer ”Auto invest” strategies. If you are anything like me, you are not the kind of investor who will navigate through all the options to decide how much to invest on a per-loan basis. You want an automated strategy.

When it comes to automated strategies, I find Mintos less flexible and more limited. It’s true that you can define a lot more variables for manual investments, but when it comes to strategies, you can only choose one type out of three (conservative, diversified, and high-yield), the amount to invest, whether you want to reinvest or not (keep on investing the profit after the maturity of the loans)… and little else.

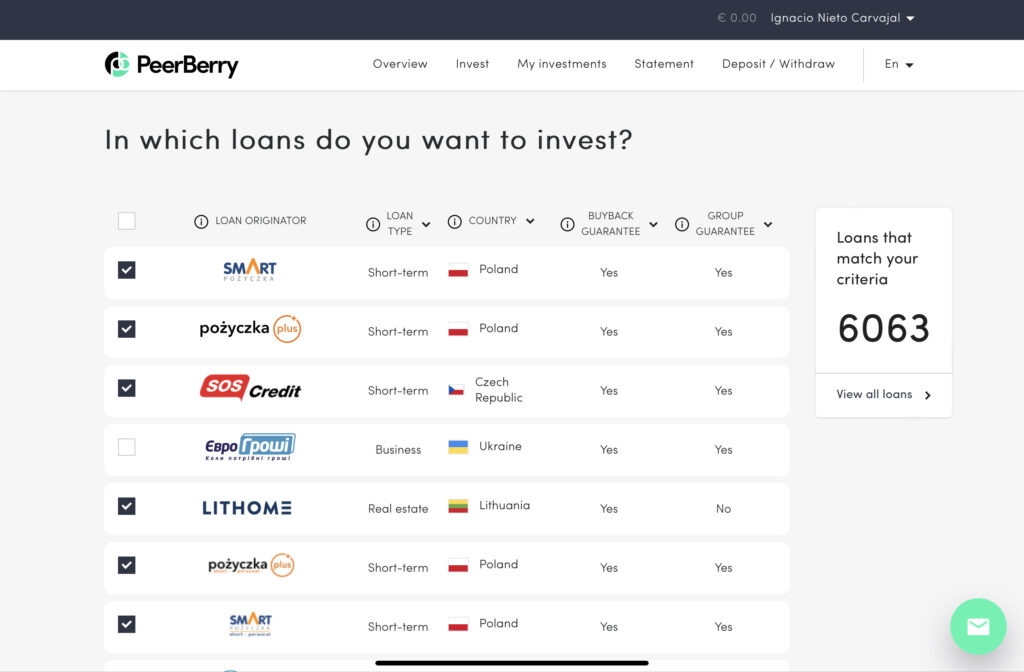

Defining an auto-investment strategy in PeerBerry may seem a bit more complicated than choosing one of three options and specifying the amount, but it is much more powerful. You are able to select from a list of loan originators (all of them are selected by default, and there are not many of them, so it is easy), amount, interest rate, whether to reinvest or not, etc.

I find Mintos automatic strategies quite limited, and manual investing is too time-consuming for me. PeerBerry’s auto-invest strategies give me just the right balance between simplicity and flexibility. Specifically, being able to choose the loan originators I want is critical, as I will explain later.

Guarantees And Reliability

Both platforms offer some kind of safety mechanisms for investors, like buyback guarantees. However, there are important differences between them in terms of reliability. Let’s see why.

Mintos

Mintos offers loan originators with and without buyback guarantee. The buyback guarantee protects you in case of default from the borrower (the individual or business receiving the money), but does not protect you in case of a defaulting loan originator. In other words, if the company lending your money to the borrower becomes insolvent, bankrupt, or can’t return your money for some reason, you are screwed.

This can happen for a number of reasons.

First, due to the COVID pandemic, some loan originators were unable to fulfill their commitments. It was the case of Capital Service and Aforti from Poland. While most of these funds were recovered (after a long process), some of them were lost forever.

Second, Mintos’ conservative strategy is definitely not conservative at all. Mintos applies a custom rating to loan originators and only includes loans with ratings B- to A+ in its ”conservative” strategy.

The problem is, these ratings from Mintos are overly optimistic. One of the loan originators included in my strategy was Wowwo, from Turkey. The recent debt and currency crisis there, with the lira crashing fast, wreaked havoc in my “not so conservative” portfolio.

Third, with the Russian invasion of Ukraine, and the situation that unfolded, many loan originators from both countries were caught by sanctions, the depreciation of the Ruble and Hryvna, or faced operational disruptions. A huge part of my portfolio was impacted too (again, note this is a conservative portfolio).

What about Mintos’ secondary market?

Mintos has a secondary market where you can supposedly sell your loans. As soon as Russia invaded Ukraine, I listed all my loans from both countries, but as of today, a large part of them are still unsold. As a result, I am quite skeptic when Mintos claims that you can always sell your loans at the secondary market for quick liquidity.

And that is my main issue with Mintos, reliability and trust. While investing is always somewhat risky, I don’t think their conservative strategy is conservative at all, as I have experienced in cases such as Capital Service, Wowwo, or the Russian and Ukrainian loans.

One can argue that nobody could predict a situation such as the Russian-Ukrainian war, and that’s true to a certain extent. But a truly conservative strategy should probably limit its loans to those from originators from geographically stable areas (i.e: the EU) with reliable, democratic, and strong economies, and a record of payment dependability.

So far, there’s no way to remove loan originators from countries such as Ukraine and Russia from my Conservative strategy, so if I want to avoid them, my only chance is going for manual investments.

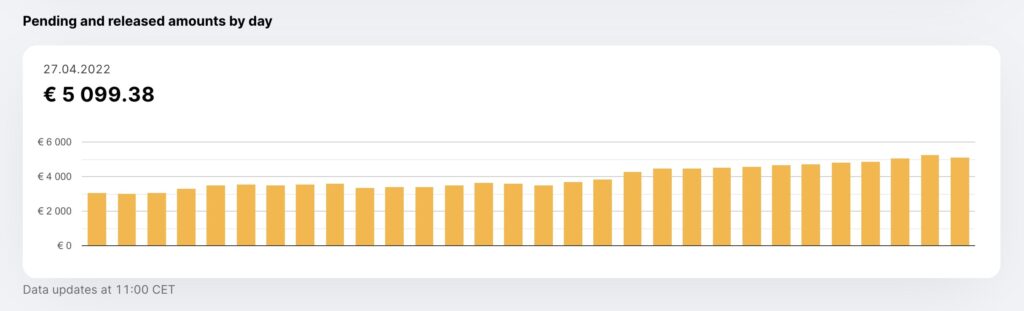

There is also another important issue with Mintos. Once the borrower pays back your money to the loan originator, the latter is supposed to transfer the money to Mintos so they can send it back to you. This process is not straightforward or immediate. As of now, I have currently more than three four five six seven eight thousand euros in ”pending payment” status for months now, and this amount keeps on growing. Mintos affirms this is normal due to the situation with Ukrainian and Russian loan originators but, curiously, PeerBerry does not even have this concept of ”Pending payments”. Your money is returned in time without intermediate steps.

Update Jul 27, 2022: Most of my funds in “Pending payment” moved to “In recovery”. I have currently 3,435.31 euros in “Pending Payment” and 12,816.06 euros in “In Recovery”. I have lost faith I will be able to recover that amount, which is quite infuriating.

PeerBerry

PeerBerry offers buyback guarantee on all loans, but most importantly, there is also an extra “Group guarantee”. In case a loan originator faces financial troubles and is not be able to implement a buyback guarantee, other companies from PeerBerry’s parent company group will cover all the liabilities of this company to protect investors’ investments.

I find PeerBerry much more reliable and secure. I have never experienced delayed payments, all my loans have stayed current most of the time (with only occasional delays of 1-15 days), and none of the loan originators have run into trouble or have defaulted as has happened in Mintos. You can’t generalize from my experience alone, but I’ve got the feeling that PeerBerry, while offering a more limited selection of loan originators, does a better job at ensuring their reliability and liquidity.

Most of my loans in PeerBerry are short-term loans (usually a month or two), so the liquidity is quite immediate. When Russia invaded Ukraine, I immediately removed the loan generators from both countries easily from my automatic strategy. As a result, the impact of the war in my portfolio was negligible.

The abundance of short-term loans, reliable and easy selection of loan originators, the ability to exclude some of them from automatic strategies , and the extra group guarantee, makes PeerBerry much more reliable and secure in my opinion. So far, after being using it for quite a long time, I have not experienced a single issue, pending payment, or funds in recovery in my investments.

Return On Investment

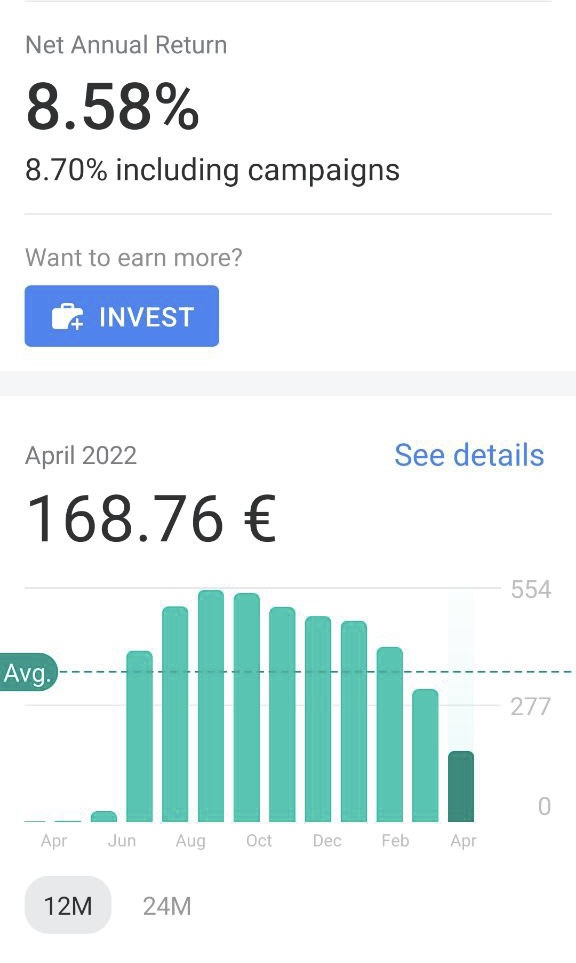

The ROI of Mintos depends on the strategy you choose. However, I find it quite unreliable and, honestly, misleading. Let me explain it to you with an example. I started a new Conservative Strategy last summer and invested there the money I got after selling my house. With an initial net annual return of 8.03% (according to Mintos), I expected to get around 480-520€/mo.

As you can see in the graph below, I quickly got to that level by the end of summer. Then the problems started. Defaulted loan originators, Wowwo, the situation in Ukraine… Month over month, I saw my monthly ROI falling well below 350€. However, the Net Annual Return kept on increasing every month! It sits now at 8.58%, up from 8.31% last month. How can this be possible if I keep on getting less for my money?

Even with the funds in recovery (3900€ this has skyrocketed to 12,816.06€ since I wrote this and growing! 😱) and the pending payments, I should still be getting close to 480€/mo if you do the numbers. So why did I barely get 300€ last month? I am sure an economist will be able to tell me, but it does not make sense that your net annual return keeps on increasing while your real ROI keeps on falling dramatically.

My experience with PeerBerry has been quite the contrary. The annual net return (around 11%) matches the money I am getting every month. It may be of course due to the absence of problems with loans and loan originators, but I find it much more transparent and reliable.

Customer support

Last, but not least, customer support. Again, my experience with Mintos has not been satisfactory. I recently got in touch with them to enquiry about the dramatic fall in my monthly ROI. After getting a canned answer (more than 5 days later), I replied asking for a real explanation offering numbers. That was the 1st of April. I am still waiting for an answer, more than 2 weeks later.

I read online that, if you invest more than 50,000€ in Mintos, you become a “VIP customer” and get prime support and a personal contact. Mintos kind of confirmed that… Ish. But it is definitely not true. I don’t get any special or privileged support (or, if I do, poor “non-VIP” customers!).

Overall, Mintos customer support is terrible. They have a bot chat for canned answers and a slow (and sometimes non-existent) email support channel.

I can’t judge about PeerBerry, because I have only contacted them occasionally for general questions. If I ever have a problem with them, I will update this post to describe my experience.

Conclusion: Mintos VS PeerBerry

In summary, in my opinion PeerBerry is a much more reliable, solid, and easy to use platform. Mintos has a lot more options and flexibility, and may be the best option for pro users, but my experience with it has been largely negative due to their lax ratings and issues with loan originators.

If you, like me, just want to set your investments on autopilot without having to worry about them too much, I’d recommend you to give PeerBerry a try.

Of course, for diversification’s sake, you should probably explore other investment channels, such as real estate, stocks, etc.

Note: this is by no means investment advice. It is just my opinion on these platforms after using them, based on my own experience.

Disclaimer: after being quite satisfied with PeerBerry, I became an affiliate of the platform. This post contains an affiliate link, which means if you start using them using this link and are happy with their services, I will get a small commission at no extra cost for you.

Comments ()