The Freelancing Fee And The Welfare System In Spain

Last Friday, I was interviewed live on a national television program. I talked about the e-Residency Program and running a business online in Estonia, and had to put up with the closed-minded comments typical of the most reactionary part of the Spanish society.

(In Spanish here).

Last Friday, I was interviewed live on the national television program "La Hora De La 1" (at 1h09m, in Spanish). We talked about Estonia, the e-Residency Program, and opening a company online, as couldn't be otherwise.

I thought it would be the perfect opportunity to explain a little bit more about this revolutionary program that I love and start a much-needed open conversation about the Spanish business system and some of the biases that can be found sometimes in the Spanish society.

Estonia... Tax Haven?

It was soon clear to me that the topic was approached from a sensationalist angle when I read the title: Estonia, digital haven... and tax haven?

A tax inspector was also present at the interview. I was greatly surprised, though, when I heard him talk. He was quite correct and professional. I was expecting some FUD speech on the lines of "The Tax Office is going after you if you open a company in Estonia, you tax evadeeeeeers!!!".

Unfortunately, it seems an important part of the population in Spain ignore that Estonia is not a tax haven, but a respectable country in the European Union. It is in fact a quite advanced country that has always kept an eye on Finland as a nordic model of society to follow since its independence from the USSR in 1991.

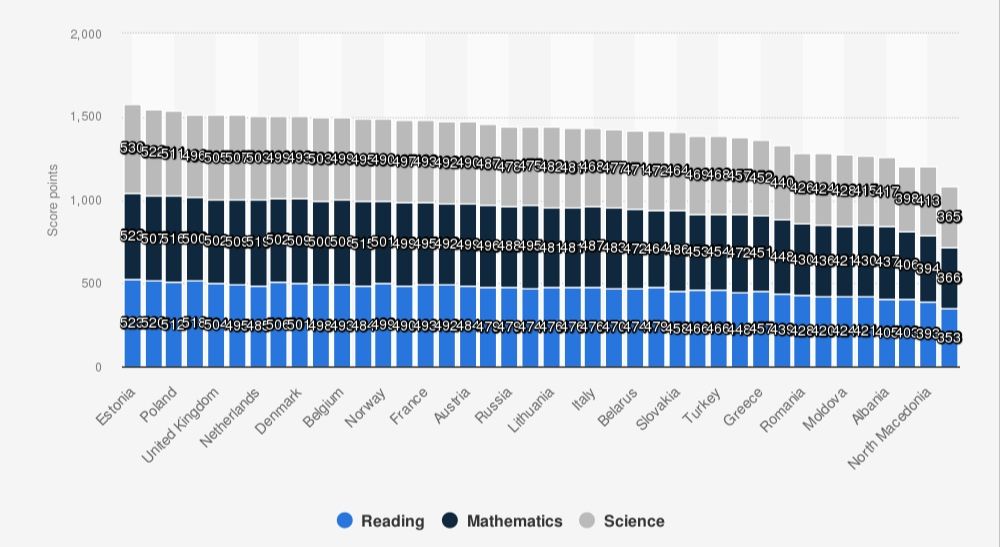

Children in primary schools generally speak three languages (Estonian, English, and sometimes Russian), and learn to code. The COO of my company moved to Estonia from Asia with his son because he wanted to give him the best education. It's no surprise, as the Baltic country topped the 2018 European PISA ranking. That year, Spain did not even appear in the ranking (for embarrassing reasons). But if it had appeared, the 2015 results tell us that it would not have been in the top 10 positions (Spain ranked 29 globally, way below Estonia, which was in 5th position).

I hope you now have a more educated understanding of what's Estonia before we continue our conversation. Shall we? 😉.

The Estonian Tax System... Or Why Comparisons Are Odious

During the interview, they asked us to compare the tax systems of both countries. It's a hateful comparison, since Estonia has topped the OECD's tax competitiveness ranking for nine years in a row (something to be proud of).

They asked the tax inspector the cost of opening a company in Spain. His answer was not concrete enough to offer a clear number, and didn't even account for the notary costs, or the waste of time and money doing all the paperwork and dancing the red tape dance.

In Estonia, starting a company costs 265 euros in state fees. They changed the law in February 2023 to allow a business to be incorporated with a minimum share capital of 1 cent. The entire process is online and no notaries are involved or paid separately, so the total cost is 265.01 euros. Estonia recently broke the world record by registering a company online in just 15 minutes.

But what always shocks the Spanish audiences is the fact that in Estonia there is no "freelancer fee". In Spain, you need to pay this fee (called "cuota de autónomo" in Spanish) every month if you want to do a professional activity or run a company. You have to pay it whether you have profit (or revenue at all) or not.

Despite discounts during the first months of activity for new freelancers, it is high, quite high, and keeps on increasing. It starts from 300 euros for those entrepreneurs who run of a company (no discounts allowed if you run a company) and will go up to 590 euros in 2025. On top of that, you pay your quarterly and and annual taxes.

That's why Spanish audiences get shocked when they know that in Estonia there's no freelancing fee. Nothing. Cero. Can you be a freelancer without needing to pay this monthly fee? Only a flat 20% tax? And only when you distribute profit or pay salaries? How's that even possible?

The Freelancing Fee Contribution and the Social Welfare System in Spain

After explaining what being a digital nomad is and what are the advantages of running your company through e-Residency, I knew someone was going to add the typical "you-are-spanish-so-you-must-pay-taxes-in-Spain" comment.

And I was right, just when I finished. One of the regulars of the program, without much knowledge of the topic, vomited it:

I really wish him to stay healthy, because the freelancing fee is not a tax, but a contribution you pay to support the welfare system, so good luck going to a hospital if you get sick, blablabla...

I've had to put up with these comments since I started writing about digital nomadism and entrepreneurship. Sometimes people are much more rude and go for something like: "Go to a Estonian hospital if you get sick then!". This illiterate bigotry is deeply rooted in Spanish culture.

Thanks for your concern about my health, but I have private health insurance. It covers me all over the world (except North America, which I'm not visiting any time soon). That includes cancer treatments, surgery, and even physiotherapy sessions, for less than I'd pay for my freelancing fee.

Also, as Mr. Cruzado -the tax office inspector- correctly said, even if you have a company in Estonia, if you live in Spain you are paying taxes there (when you submit your personal income tax report, when you receive dividends, etc). Those taxes pay for the hospitals, schools, etc. You and your company are separate entities (when companies get sick they don't go to hospitals, they go bankrupt, so don't panic, my Estonian company won't abuse your Spanish public healthcare system ;).

The Freelancing Fee In Spain, A Competitive Disadvantage

Finally, Spanish people fail to understand that these freelancing fees are the exception rather than the norm. Few countries ask you to pay a fee just to "have the privilege" of being a freelancer or running a company. And definitely none has a fee as high as in Spain.

Without paying this fee, and even with such a business tax regime (that by the way, is not only for foreigners, as the tax office inspector claims, but for EVERYONE, including, of course, their citizens), Estonians enjoy a perfectly good welfare system. If they get sick, they go to the doctor or the hospital (which are indeed quite good) and when they retire they have their pension. Like every other European. And they don't need the freelancing fee for that.

This fee is neither necessary nor a guarantor of the welfare system. If instead of having buckets of poor autónomos (freelancers) drowning in taxes and struggling to make ends meet, Spain had a system that allowed entrepreneurs to grow, hire employees, and get rewarded for their hard work (benefiting their socities in the process), we will have a much better welfare system without so much tax pressure.

The freelancing fee in Spain is culturally similar to gun violence in the US. It's something nobody out of that country understands, and yet it is so ingrained in their society that it's almost impossible to change. Just as not even the most progressive voices in the United States demand a total ban on weapons (at most, they only dare to ask for better regulation), it is incomprehensible that not even the freelancer organizations in Spain request the end of this fee.

Spain 👎, Estonia 👍? No!

Spaniards have a tendency to see things as either black or white. However, things are never that simple. No country is perfect, and I can confidently say this after being a digital nomad for 7 years.

Spain is a great country, full of wonderful, talented people. It has a lot of sunlight, amazing food, music, culture, and joy. We are open-minded, hardworking people (my company has 40 employees from more than 10 different countries, so I can compare). We have many things to be proud of.

But we have to stop living with our backs to the world. We must understand that there are things we can improve, and that if there are countries that are doing some of these things better, it is perfectly OK to copy these good ideas and apply them in Spain.

Unfortunately, I find Spain a great country for tourism, but not a place interested in becoming an open, modern, and competitive nation in an increasingly global and digital world. It is not a place for entrepreneurs.

When Spaniards face this reality, their first reaction is blaming others (the socialists, the conservatives, the evil businessmen, us, them...). That's part of the Spanish "¡y tú más!" (you did it too) political culture. Instead of acknowledging that we are doing something wrong and working together to change it, we just blame the other group because they did the same before. We need politically-neutral visionaries like the ones Estonia had in the early 90s with a lot of courage to change things.

If a small country of just over a million inhabitants was able to do it after a devastating Soviet past... Why can't Spain do it too?

Comments ()