Can your business remain in Europe after Brexit thanks to e-Residency? Probably NOT. Here is why.

It happened. Populism, fear, and a highly successful democracy hijacking act on Facebook, targeting vulnerable Brexit swing voters, won, The UK left Europe. Farewell, friends.

Still shocked by the turmoil of the Brexit, many British companies started to look for ways to escape the fanaticism of their own politicians. The e-Residency program came to the rescue, promising them a solution to keep their businesses in Europe after Brexit.

Is the e-Residency Program indeed a solution for them?

As you know, I consider myself an ambassador of the e-Residency Program. It changed my life. I am not only an e-Resident myself, but also the CEO of Companio, one of the most successful business service providers of the e-Residency Program of Estonia. My life is devoted to help other entrepreneurs and companies run their location independent business online.

Still, in this post, I explain why, as a British entrepreneur living in the UK, e-Residency may NOT be that promised solution you are looking for. As much as I love e-Residency, or maybe because of that, I think it is fair that before opening a company in Estonia, you understand if it is good for you.

Why Estonia and the e-Residency Program

Needless to say, the consequences of Britain leaving the largest single market in the world will not be positive for business, not in Europe, but specially not in the UK.

As Brexit deadline approached, many British entrepreneurs rushed to look for options to keep their businesses in Europe. The most obvious one is e-Residency. The Estonian program allows anyone to open and run a European company completely online.

Far from the online management, the benefits of owning a Estonian company are just too many to name here. Paperless administration, zero bureaucracy, a fair tax system that allows your business to grow, a government that understands location independent entrepreneurs… It seems too good to be true. But it is.

The program brings also a lot of revenue to the country. Thousands of companies founded by entrepreneurs from all around the world have been established in Estonia. Apart from the state fee you need to pay to the government (100€) to become an e-Resident, many of these companies pay taxes to the Estonian government every moth.

It is then understandable that the Estonian government makes a remarkable effort to promote this program. They have productized their amazing digital society and smart business system in a package that, honestly, can change your life if you are a location independent entrepreneur.

Can you own an Estonian company while living in the UK?

Still, we know silver bullets don’t exist. Even antibiotics are losing their power due to misuse.

And e-Residency is not an exception. It does not work for all kinds of businesses or entrepreneurs. They must meet two requirements.

First, the business needs to be digital. It needs to happen in the digital world. Online marketing, development, design, a startup offering a SaaS product, a dropshipping company, a youtuber… Do you have a restaurant? This is not for you.

Second, the business needs to be location independent. That means not only not having your HQ in the UK, but also not living in the UK. Why?

The UK, as many other countries, has CFC (Controlled Foreign Corporation) rules. These rules were designed to prevent citizens of high-tax countries to open companies in low-tax territories, such as tax havens.

Unfortunately, these rules affect all countries, not just tax havens. So even though Estonia is not a tax haven, but a reputable European country, these rules affect Estonian companies established by British nationals too. In other words, if you open a company in Estonia, but stay in the UK as a tax resident, the British Tax Office will eventually declare that your company needs to pay taxes in the UK.

If that happens, you will lose most benefits of owning a company in Estonia, including the smart tax system and the ability to submit all reports online. You will need to submit your tax reports to the British Tax Office. You will still be able to manage other aspects of your company online, but fulfilling your obligations for a Estonian company in the UK will be much more problematic than having a British company.

If you, however, are a location independent entrepreneur, nomad, or are ready to leave the UK behind: Congratulations! I honestly can’t think of a better option for your business than the e-Residency program of Estonia.

Next station: the e-Residency program?

There has been a huge marketing campaign to promote e-Residency in the UK since Brexit was announced. That includes ads in some underground stations in London.

This other one says: “The UK is leaving the EU. Your business doesn’t have to.”

While I am a strong supporter of the program, and I believe in a future without borders, limitations and barriers, I also think we need to be realistic. Who is going to see this ad?

Most probably, if you are seeing this ad, you live in the UK. It may happen that you are a British digital nomad visiting the family for Christmas, or you have a global startup, but I would dare to say that 99,99% of entrepreneurs seeing this ad are UK residents.

Then, I believe it is only fair that you understand, when seeing this ad, that if you live in the UK, the e-Residency program of Estonia may not be the best solution for you. You can’t cheat the system. If you live in the UK, you will eventually trigger CFC rules, and trust me, you don’t want to manage a business in one country and pay taxes in another, regardless of how clear the taxation treaty between Estonia and the UK is.

Towards a truly European Europe… In business too

The European Union was certainly one of the best ideas of the 20th century. European citizens enjoy amazing benefits, such as being able to live and work anywhere in Europe.

But the European Union has still a long path to walk to fulfill the European dream. Apart from unifying company types, taxes and VAT throughout Europe, one of the most flagrant omissions of the European law is the ability to own a European business while living in any other European country.

I think it makes a lot of sense. If we (supposedly) don’t allow tax havens in Europe, and I can live and work anywhere in Europe, why can’t I own a business in Estonia and live in Spain? In a tax-haven-free environment, avoiding taxes is not an option, so CFC rules between European countries lose their significance.

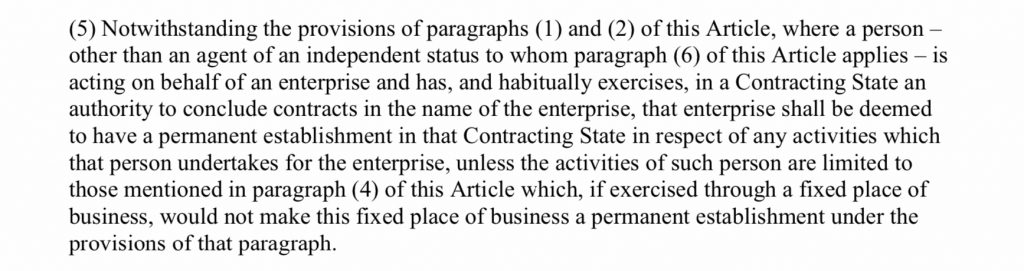

I understand European governments… They are scared. If we remove the clause nº5 of the definition of “permanent establishment” from our double-tax treaties… won’t all our citizens open companies in countries offering them better business environments? But, what if instead of being scared, you improved your systems to make them competitive and attract business? Or even better, you unify the concept of company throughout Europe?

Yeah, I know, sounds crazy, huh?

The world has changed. Internet has disrupted every aspect of our society, and business is no exception. A vast majority of the businesses of today are online. They happen in the digital world. They are not tied to any specific location.

I hope Brexit will bring something positive to Europe. It should serve as a wake up call to fight against the raise of populism and far left/right wing movements in Europe. Our European politicians should step up efforts to build a more unified Europe, remove barriers and promote the advantages of being European among their citizens…

But above all, our politicians need to understand these disrupting changes that internet, and the digital age, have brought us. They need to embrace technology, not fight against it. Estonia, a pioneer in digital societies, has already understood that. Europe needs to up the ante.

We deserve a better Europe. The Europe of the XXI century. Let’s build it together!

Conclusion

On the wave of Brexit, all the confusion, the uncertainty, and the (mis)information overload, many British entrepreneurs are looking for ways to escape from one of the biggest mistakes in the history of Great Britain. The e-Residency has been promoted as the holy grial to help them keep their businesses in Europe.

In this post, I share my thoughts on why, as a UK resident, the e-Residency program of Estonia may not be the solution to your problems.

Comments ()