Starting A Company In Estonia Changed My Life [Updated 2022]

![Starting A Company In Estonia Changed My Life [Updated 2022]](/content/images/size/w1200/wordpress/2017/09/16591811764711.jpg)

I own a company in Estonia and I run it completely online, wherever I travel. This experience has changed my life. In this article, I describe how starting a company in Estonia can help you embrace a simpler, happier life as a location-independent freelancer, digital nomad, or entrepreneur.

Why Starting A Company In Estonia

Some time ago, my partner and I decided to break the chains of our 9 to 5 jobs and become digital nomads. I had a company in Spain but managing it, complying with the tax office, and fulfilling all the legal requirements was a nightmare for me.

The outdated Spanish administration is not ready for the businesses and professionals of the digital era, freelancers, location independent entrepreneurs, digital nomads, micropreneurs, or startups.

Spain, like many other countries, makes managing a business unnecessarily hard for a developer or designer who just wants to work, earn money, and enjoy a normal life with what he or she earns.

The whole Spanish business system (like many others in Europe) seems purposely designed to confuse people. As a freelancer with no financial background, I needed an accountant because I was not able to understand my tax duties, including how much taxes I was supposed to pay and why, or how to fill and submit quarterly and yearly reports to the Tax Office. We are talking about a single freelancing business activity with one or two invoices per month.

The Freelancer Fee

To make things worse, if you want to work as a freelancer in Spain, or found a company, you need to pay a monthly “fee“, called the “Cuota de autónomo”. You need to pay this fee even if you don’t earn any money during that month. When I was in Spain, it was around 285€ just to be a freelancer or 340€ if you owned a company, every single month. On top of that, you pay of course your taxes every quarter and then again yearly. The cuota just gives you the privilege of working as a freelancer or running a company.

Many other countries in Europe have some kind of “microbusiness” or “one-person company” schemes designed to help freelancers to get started with their businesses. Entrepreneurs incorporated as micro-companies usually enjoy tax reductions or at least some special benefits to help them at the initial stages of the business. Still, in most cases, there is a lot of red tape involved.

Feeling Trapped

Back in Spain, I was feeling trapped. I earned a lot of money working as an iOS freelance developer for startups from all over the world. However, I was struggling with my business, due to the overwhelming red tape and the unfair tax system.

Life in Madrid is expensive, and I had the feeling that I was working a lot (65-70 hours per week) but never earning enough money.

Most importantly, I was never sure if I was doing things correctly. Can I deduct this expense? Am I issuing my invoices correctly? Should I add this extra tax here or not? The Spanish business system is hard to understand, full of cryptic rules (some of them contradicting other rules). Every time I asked my accountant, I received ambiguous answers, leaving me even more confused.

Once, the tax office fined me because some of my customers didn’t pay the taxes from my invoices correctly. I was outraged, so I spent a lot of time and energy trying to appeal this decision, only to be fined again for not paying in time. Fighting against the Tax Office in Spain is a David VS Goliath scenario. You can’t win, even if you are right.

As a result, I was feeling unhappy and frustrated. I had freedom, worked remotely, and was able to choose my customers and work on the stuff I loved, but I never had the feeling that I was in control of my business.

A One-Month Trip To Latvia

Decided to become fully location independent, I started looking for alternatives out there. It took me some time until a lucky series of coincidences put me on the right track.

At that time, we were members of TechHub Madrid at Google Campus. However, soon after we joined, without notice, TechHub announced that they were closing their space in Madrid.

To make up for such an abrupt end (some of us had just recently paid our yearly subscription fee), we were offered a free subscription to any other TechHub community around the world.

We had been living for at least a month every year in a foreign country, working there and living like locals. It’s quite an enlightening experience. Thus, we thought it was the perfect opportunity to visit a new place and merge with a different community of entrepreneurs.

We had a look at the available locations. South Korea was too distant, and London was too expensive, so we opted for Riga, Latvia.

Latvia is a European country, but an affordable one. It was different, exciting, and new, and I feel personally comfortable in small cities. It looked like the perfect place to stay for a month.

Thus, we spent July in Riga and I fell in love with the city. While living there, we made up our minds. We wanted to become full-time nomads. A new exciting chapter of our lives was about to begin…

… but what about our companies?

But we still had an important piece of baggage we had to get rid of. Our companies in Spain. The more time we spent outside of Spain, the more difficult it was to manage our businesses. One day, the community manager of TechHub Riga mentioned the micro-company system in Latvia, a special kind of organization designed for solopreneurs and small businesses, with reduced taxes, almost no paperwork, and great conditions for new businesses. That was the first time it occurred to me that my business didn’t have to be in Spain just because I was from there.

But a company in Latvia was not an ideal solution either. There was still a lot of red tape, and I would eventually need to do some paperwork there. That meant staying in Latvia and running my company from there. We were not sure how long we wanted to stay in Riga… And then, what?

Enter Estonia

That night, I talked to my friend Luke Kelly and told him about my plans. He is a location-independent designer and has been traveling the world for years.

He told me “You should check out Estonia, they have this e-Residency program that allows you to start and run a company online from anywhere“.

I was intrigued, so I had a look at the e-Residency program of Estonia and I realized that I could use it to incorporate my company completely online, without middlemen, and let a business service provider take care of my accounting, taxes, and compliance for much less than I was paying to my Spanish accountant.

Too good to be true?

The e-Residency concept seemed revolutionary to me, too good to be true. There are many places where you can open an offshore company, but this was something different. The Estonian digital nation was all about democratizing business in a digital, transparent, and secure framework. The more I read about it, the more excited I was.

By becoming an e-Resident, you get a digital identity contained in an ID card issued by the Estonian government. This card, containing a cryptographic chip, allows you to authenticate yourself and sign legally binding documents.

Most importantly, with that ID, you can open a company in Estonia and run it from anywhere, totally online.

I did read a lot about the e-Residency program. A lot. I realized it would allow us to run our businesses easily while traveling. I also talked to some other digital nomads who were running their businesses in Estonia.

Finally, with all the information in my hands, I made up my mind. I decided to found my company in Estonia!

The Plan

The plan was simple. We would officially move to Riga to start our digital nomad journey. At the same time, we would apply for e-Residency to incorporate our companies in Estonia. Once we had our setup ready, we will travel the world as digital nomads, running our businesses on the go.

Moving To Riga

By the end of July, before traveling back to Madrid, we went to the Immigration Office in Riga to register our temporary residence in Latvia. That will allow us to cut ties with our home country, Spain. I talk about this process in another post.

Next, we talked to our Airbnb host and asked her to extend our rental agreement for six months. Fortunately, she was very happy to host us for as long as we wanted. Yay! We were now officially residents in Latvia.

Then, the next step, and probably the most difficult one, was cutting ties with Spain.

We told our landlord in Madrid that we were moving, and got rid of all of our stuff. It was a hard process for me, especially selling my piano.

Becoming e-Residents And Starting A Company In Estonia

Before starting a company in Estonia, you need to become an e-Resident. The e-Residency program opens the doors to a whole new world of possibilities, from accessing the online Estonian administration to digitally signing documents.

I explain how to become an e-resident, the application form, requisites, and all the steps involved in the process in this article: “The Process of Becoming an Estonian e-Resident“.

Service Providers For Starting A Company In Estonia

There are many providers that can help you to incorporate your business, but it’s important to find the right one for you. Accounting, taxes, and all that stuff is not just boring, but distracting for us, entrepreneurs. We want to focus on doing what we love and growing our businesses.

I recommend you take a look at Companio. They offer the most complete platform to run your business, and they take care of all that dull stuff (compliance, taxes, accounting…). You just need to connect your bank account and, every month, upload your invoices. That’s all. Easy and hassle-free. And they include virtual office services for free.

Yes, you could do the bookkeeping of your company yourself, but I honestly think that your time -like mine- is probably worth much more than the monthly fee you pay to a professional company to manage that for you.

One of the main selling points of Companio is the fact that it supports companies with multiple owners, employees, contractors, and all kinds of businesses, including those requiring specific licenses (such as crypto-companies). Their winning point is their back-office, which automates most of the stuff you need to do to run your business.

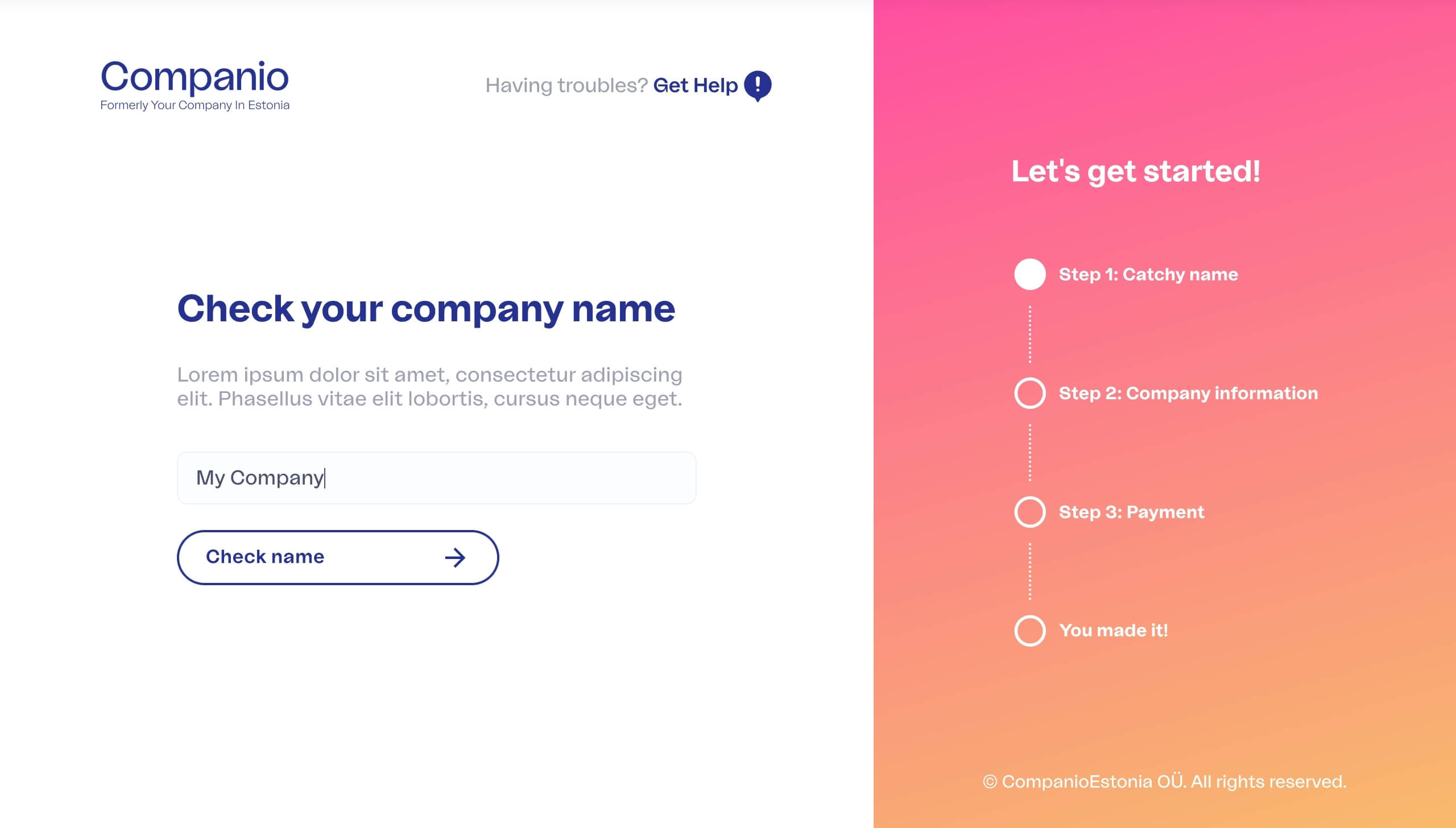

Starting A Company In Estonia In Four Steps

While you need to be an e-resident before you can incorporate your company in Estonia, you can start the process right away, and then apply for e-Residency later. Here’s how.

Start the process by going to the registration assistant. First, you need to enter the name of your company to make sure it is available.

The name of your company should be unique and distinctive from other company names. It should also be different from any registered European or Estonian trademark unless you get explicit and notarized consent from the owner.

The fact that you can just look for the name of your company easily on a website, coming from Spain, was another shock for me. In Spain, before you can start your company, you need to obtain a “Negative name query report” that guarantees that the company name is available. This report costs some money and it’s only valid for a limited amount of time. In Estonia, it is as simple as searching for the name on a website or asking for that information from your service provider.

If there’s a similar trademark name or a company with exactly the same name, you need to come up with a new name. If there’s no similar trademark name, but there are companies registered with similar names, you will receive a warning and may be asked to choose a new name later. Otherwise, you will be able to continue to the next step.

Filling in your company data

Next, you need to specify who will be the members of the company. For each person you add, you need to decide if she is going to be a shareholder, board member, or both. You can also specify that this person will be the representative of the company (for business-related matters).

If the members of the company already have their e-Residency IDs, that’s good news. They will be able to sign the incorporation of the company right away. If not, don’t worry, you just need to specify their birthdates, and the registration process will continue as soon as they get their e-Residency cards.

Finally, you need to specify the activity of the company, its email, and optionally a phone number too.

Overview and payment

Next, the system will ask you to verify all the information. Make sure to check that everything’s correct. If everything looks good, proceed to the payment.

Becoming an Estonian e-Resident

That’s all! If all the members are e-Residents, the company registration usually takes 48 hours on average!

I talked about the Process of Becoming an Estonian e-resident before. If some of you are not e-residents yet, you need to apply on the official website. You will need to submit some information about yourself, including your citizenship, date of birth, and personal data, and upload some pictures of your passport and your face.

Once your applications are approved, you have to wait until all of your ID cards have arrived. It usually takes 3-4 weeks, so be patient!

Signing the company registration and services contract

Finally, when all the members have their e-Residency cards, they can sign the service provider’s agreement to continue with the company registration process. The process is really fast.

First, the e-Business registry sends you an email to verify your corporate email. Then, all members have to access the e-Business Registry and sign the application. In 24 to 48 hours, the company will be registered, and you will receive the official document containing all the information of the company, including its registry code.

This unique code, along with the name and address of your company, identifies it univocally, and you should include it on every invoice you issue to your customers.

Then, it’s time to open your bank account.

Opening your Bank Account

Your business won’t be able to do much without a bank account. Fortunately, there are plenty of options to open one:

- You can open a bank account in a traditional Estonian bank such as LHV.

- You can open a bank account in any traditional bank of the European Economic Area.

- You can use an online banking provider such as Wise or Revolut Business [RECOMMENDED].

The main disadvantage of opting for a traditional bank is that you are required to physically go to their premises for their AML (Anti-Money Laundering) checks. It’s part of their KYC (Know Your Customer) protocols.

Edit: Today, online business solutions work so well that, for most location-independent business owners, the best solution is an online banking provider.

In our case, as we were living in Riga, which is only 4 hours away from Tallinn, and LHV had no fees for non-residents back then, we decided to travel to Estonia and open a bank account in LHV. We went there by bus.

Once we got to the bus station, we got into a cab, and some minutes later we arrived at the LHV headquarters, where we met Marje. She was really nice and welcoming, making the AML experience a real pleasure.

However, Estonian banks are making it much harder for non-residents to open bank accounts for their companies these days. They now require a “strong connection” to Estonia from the founders of the business, which is usually difficult to prove for location-independent entrepreneurs.

… A very positive trip!

We left the bank, and I met a startup that was looking for an iOS developer. The meeting was very positive, and some days later I joined them as their new mobile developer. We got back to Riga some hours later.

I would call that time well spent.

What’s Next

Once everything’s ready, the fun begins! Here are just some of the exciting things that feel completely different when done in a completely digital setup.

The Big Day: Issuing your First Invoice

The most memorable event, once the company is ready, is when you issue your first Invoice!

I can hardly describe with words how amazing it makes you feel. I still smile when remembering how nervous I was when I prepared the invoice for my first customer. How to describe that sensation of being able to do everything from an online platform, in a couple of clicks?

If forced to choose a word, it would be: freedom.

I had my business in front of me, at my back-office. I could issue invoices easily and send them to my clients automatically. All those invoices and expenses gave me a good overview of my business, and the tax system, regulations, and requirements were crystal clear. I won’t pay any taxes for the money that the company earned. I would only pay taxes if I distributed profit, and that was 20% flat.

For the first time ever, I understood all I saw. And that gave me peace of mind.

VAT Number and Operating in the EU

As part of the registration process, you get a European VAT number. This number makes it easy for your company to deal with customers and providers from the European Union. Another advantage of being VAT liable is that you can deduct VAT from other EU businesses and that you add 0% VAT when invoicing other EU businesses.

Getting a Debit Card

Once you open your corporate bank account, you should get a debit card. In the case of LHV, this card has a monthly fee (2€). It’s sent to the official address of your company. If you are using the services of a business provider such as Companio, they will pick it up for you and send it to your location of choice. That’s part of their virtual office service, included for free in their monthly fees.

Debit cards on most online banking solutions are completely free. Another reason to go digital! Once you have your corporate debit card, you can use it to pay for business expenses.

You have your EU company ready, a valid VAT number to do business comfortably in the European Union, a corporate bank account, and a debit card.

Everything’s set up. And the best part, you don’t have to worry about accounting, taxes, or compliance. You can focus on what you do best: working on the stuff you love, finding new customers, and growing your company.

Conclusion

In this article, I explain why starting a company in Estonia changed my life. It is the perfect setup for freelancers, digital nomads, startups, solopreneurs, and small businesses willing to embrace a global, digital world.

As Bob Dylan said, The times they are a-changin’. The future of business is online and borderless, a future where everybody can work, live, and do business from anywhere. Initiatives like the e-Residency Program have democratized business, and offered equal opportunities to everybody, regardless of where they live. But this is just part of an ongoing revolution.

The nomad lifestyle is slowly but steadily spreading and being adopted by more and more people every day. Startups are becoming decentralized. Companies are looking for talent in every corner of the world. Employees are quitting, leaving their offices, and becoming freelancers.

We need tools to work in this new business framework without worrying about borders, paperwork, different tax regulations, etc. Estonia was one of the very first countries to realize that.

I know that not everybody is ready to embrace this change yet. I am not saying this is the ideal solution for everybody. As for me, starting a company in Estonia changed my life. I could not possibly think of going back to a traditional business setup.

Comments ()