What Spain -Or Your Country- Could Learn From Estonia

Today, I received an email from my Spanish accountant.

You have an alert from the tax office. Can you have a look at it?

As soon as I read that, my heart skipped a beat. That was not good news, and probably not the best way of starting the week.

I went to the Spanish Tax Office website. After spending ten minutes navigating through pages filled with options, I managed to locate the login button, access, and download a document.

I started to read that document and my worst fears confirmed.

Let Me Introduce You To My Defunct Spanish Company: Letusdo S.L.

I co-founded a company in Spain in January 2016. We were at the stage where our startup was getting serious, and it felt like the right thing to do.

Unfortunately, due to several problems, the startup didn’t quite work. Thus, we decided to close it one year later.

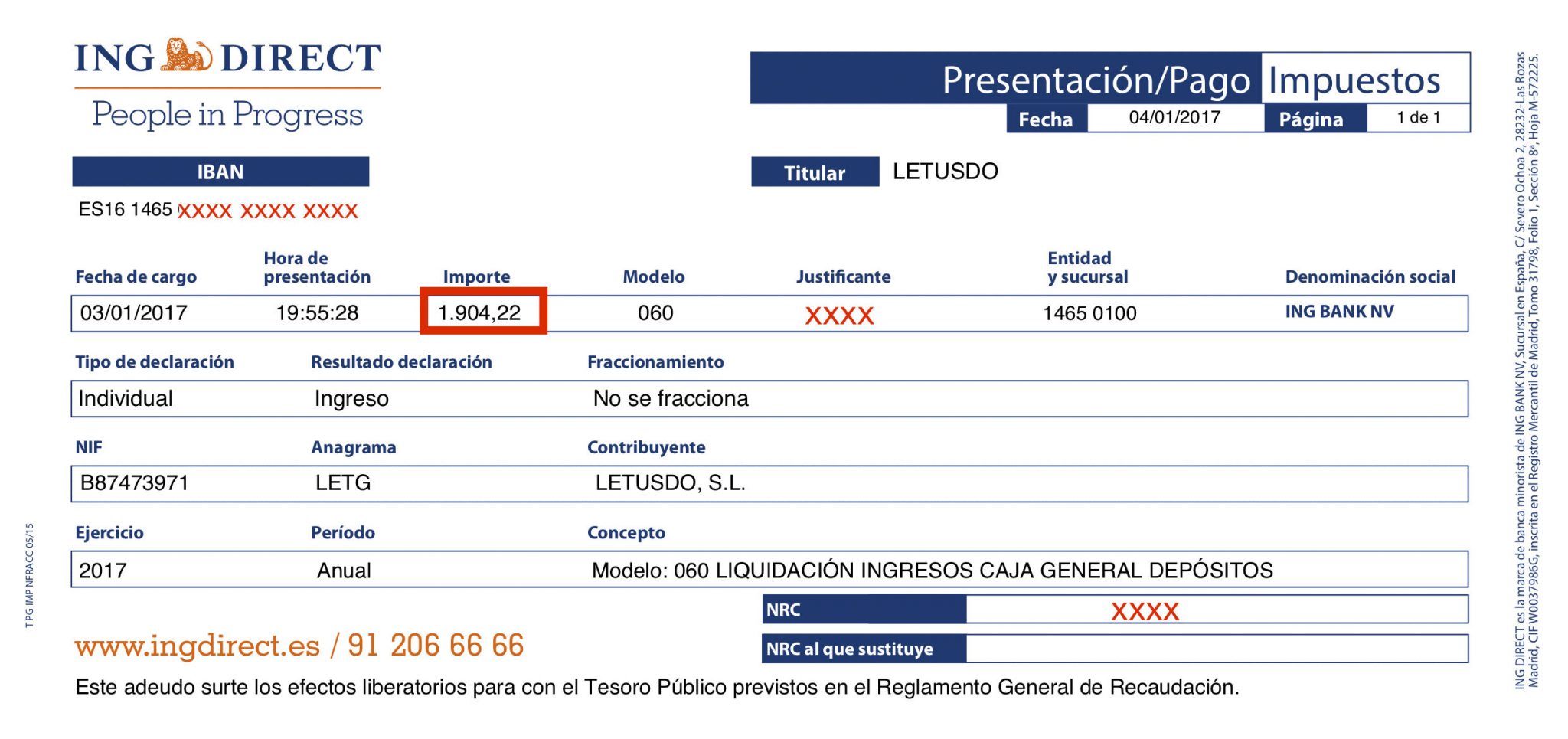

As we had earned some money, in order to comply with the Spanish tax regulations, we needed to deposit an amount of money for the taxes.

Long story short, as we were about to close the company, and its associated bank account, we needed to deposit the money in advance at the the Spanish General Savings Deposit. I had to physically go there and ask for a payment form. Then, do the actual payment.

That was quite an unsettling operation. This governmental institution, while belonging to the Finance Ministry, it’s not part of the Tax Office itself. You also don’t get any official notice or receipt beyond the bank statement below.

Now, one year later, I receive this document stating they don’t acknowledge that payment and ask me to pay that amount again. You will notice it’s almost 2000 euros I have already paid and, honestly, I don’t have that kind of money to spare.

The Problem

So, why did this happen? Well, there’s a myriad of things going wrong here. From the fact that I wasn’t properly notified of this document -luckily for me my accountant entered my account to close some pending stuff-, to the mess of bureaucracy and different institutions that plague the Spanish administration.

Simply put, the Spanish administration is broken. Especially, the Tax Office.

I honestly don’t know anybody in Spain that would say that making their tax statements was a fast, easy or seamless experience. I know, however, quite a bunch of terrifying anecdotes my friends have shared with me during the years.

The problem here is obviously twofold:

First, the Spanish Administration, while not unreasonably oversized, is completely fragmented. The problem is not the number of administrative levels and divisions we have, it’s the fact that they are isolated. Every administrative region, department and even ministry works with their own databases, networks, processes and websites. That’s a complete organizational disaster.

Second, the Spanish Administration is strongly anchored to the past. There’s a lot of red tape, paperwork and different offices for every single thing you can imagine. Most of the procedures require you to physically go to a different set of offices in a gymkhana-like sequential fashion.

I actually thought this was like a “normal” situation, until I became a Estonian e-Resident and opened a company in Estonia.

What Spain -Or Your Country- Could Learn From Estonia

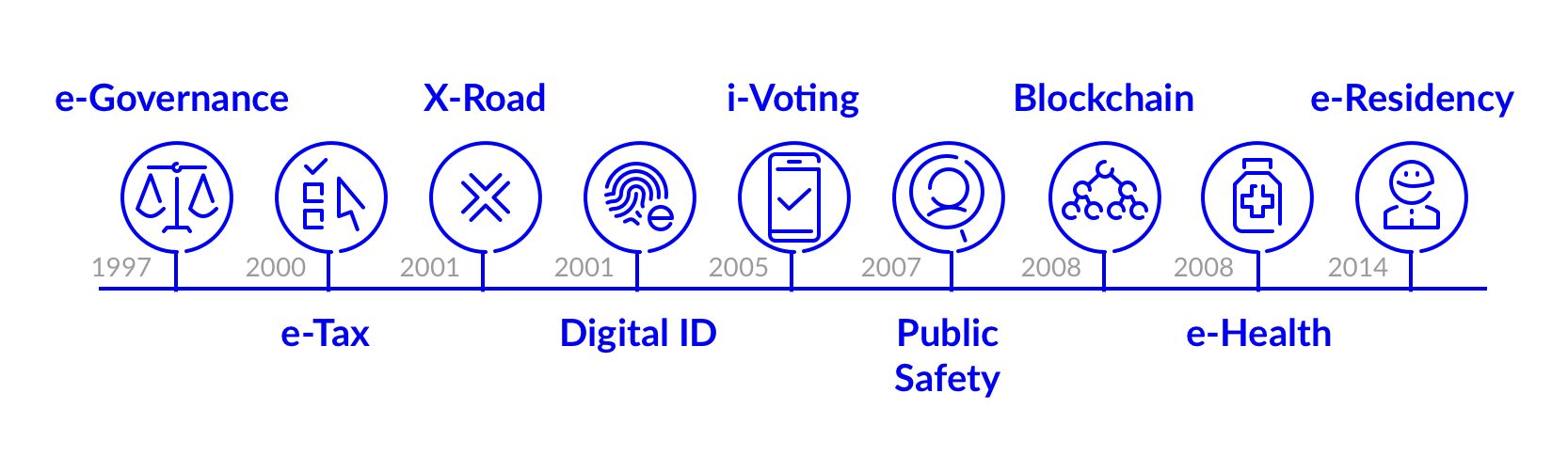

Enter Estonia, or more concretely e-Estonia. Under the umbrella of this concept lies a series of initiatives to progressively digitalize every aspect of the Estonian society.

I am not stating here that Estonia is the only country that has applied all these measures. Spain implemented the digital id for its citizens in 2006. However, it’s a total failure, and a very expensive one. While in Spain I worked and used to hang out with people from a technological ecosystem, I have never used my digital ID for anything, and I don’t know anyone who has either:

Even when dealing with the government, Spaniards only use DNIe to book appointments rather than to submit papers or digitally sign contracts, as El Pais reports. Adoption of the technology in the country is far behind that in Estonia, for example.

The recent vulnerability affecting both Estonian and Spanish ID cards has brought to light the differences between both countries. Basically, what Estonia has managed to do is effectively applying these initiatives to digitalize and modernize its society, not just a charade to justify government expenditure.

The e-Residency program is just the last piece of this big puzzle.

So, what Spain -or your country- could learn from Estonia?

Use Technology To Improve The Lives Of Your Citizens

It’s freaking 2018. Let’s use the technology at our disposal to our advantage.

I have been able to open a company there with minimum effort, from the comfort of my couch. I only needed to visit the country once to open the bank account at LHV, and that’s not even necessary if solutions like Transferwise work for you.

The e-Estonian infrastructure allows everybody in the country to develop services and products on top of it. Not just for its citizens, but for e-Residents like myself as well.

That makes it possible for Companio, my business service provider, to calculate the taxes that I have to pay for a month, and send me a bank payment request via my authorized contact. Then, I just need to access my bank account and use my finger to accept it.

That also makes possible for me to sign a job contract with an Estonian startup by just using my digital ID, or contract a mobile phone plan without typing a single piece of information.

We live in the era of internet, online services and the blockchain. Technology can help make a better world. Let’s take advantage of that.

Build A Transparent, Easy To Understand Tax System

If you are a freelancer in Spain, chances are you need an accountant to pay your taxes. We are talking about the most simple jobs, including developing software and getting paid for it -you deliver one piece of software, you get paid, easy right?-.

If you have a company, you cannot survive without one. Probably, you need someone in your company exclusively devoted to accountancy, taxes and VAT.

The Spanish system is so complicated, that I don’t think any of my friends in Spain, who are freelancers or entrepreneurs, really know how it works.

Conversely, Estonian system is plain simple, and easy to understand. I talk about it in depth in this article.

If someone else didn’t take care of my accountancy, I probably won’t be able to do it by myself. But even if I could, I’d rather use my time in what I do best. You shouldn’t do everything yourself.

The fact here, however, is that the Estonian tax system, especially for companies and entrepreneurs, is clear and simple. You know beforehand how much you are going to pay. When you run a business, that’s priceless.

Unify The Administration

This study of the European Commission lists the countries adhering to the “Only once” principle. This principle, in theory, establishes that a government or administration shouldn’t ask its citizens for the same data twice.

I was very surprised to find Spain listed among those countries. Obviously, the study has not been conducted very seriously.

As an example, in Spain, public healthcare is different in every region. Here, “different” means different registries, systems and databases. When I moved to Madrid from my home town, Murcia, I had to register again for social healthcare and, yes, give all my data again, to have access to healthcare in Madrid.

In fact, it’s easier for me to get medical attention in any European country than in Malaga, Galicia or Barcelona.

That is just an example, but it applies to the whole Spanish administration. Want to ask permission for renovating your house? You need to go to the Town Planning Office first and ask for a document proving that you own that house. A printed document.

Then, you need to take it to the Executive Office for Urban Planning, Development and Construction… Last time I asked for this license, I had to visit seven different offices, including the local police department.

Thus, Spain is a long way from having a unified administration that solves citizens’ problems instead of making them worse. Here, unified doesn’t necessarily mean “centralized”. Estonia’s digital society builds on top of the X-Road technology and the distributed KSI blockchain.

Give Trust To Your Users

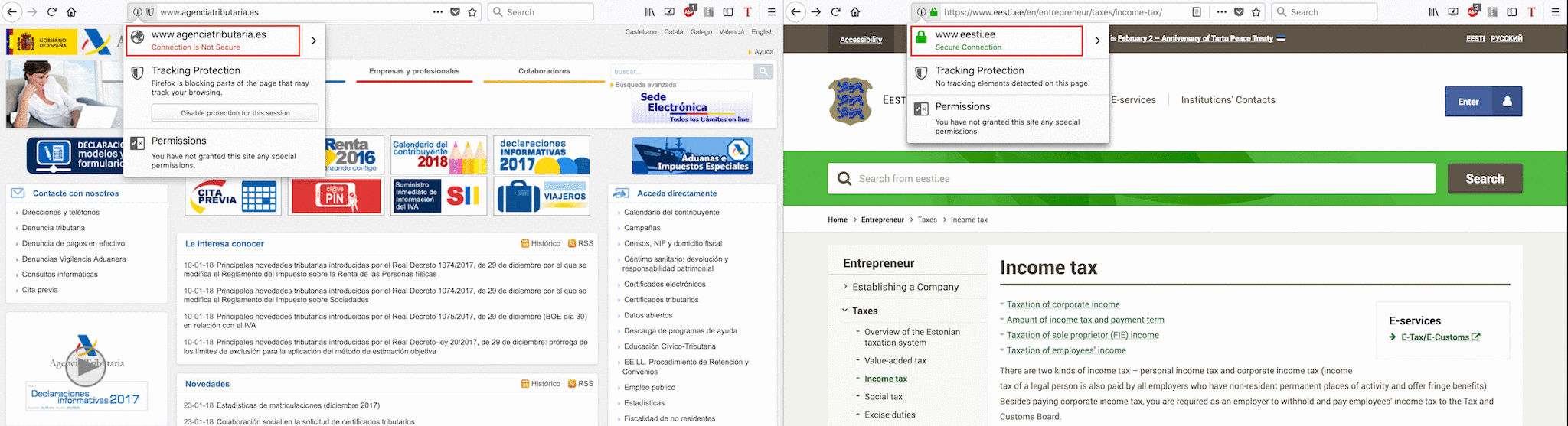

Have a look at the figure below, comparing the Tax Office websites for the Spanish (left) and Estonian (right) administrations. Notice something?

Yes, that’s true, the official Tax Office website for the Spanish government uses an insecure, untrusted certificate. Most browsers will actually prevent you from accessing the website unless you add a security exception.

Of course, you can download and install a custom certificate, and then your browser won’t complain… but that’s not only a hassle, is does not give me any trust.

How do I know that certificate is really secure? What if I want to access the website from my Android phone or my iPad? Would my mother be able to download and install that certificate?

While I don’t expect the Spanish government to implement a blockchain-based solution or something similar to Estonia’s X-Road, I certainly expect them to buy a proper, trusted certificate for the official government websites.

Heck, this website uses a SSL certificate that costed me 8€. I’m pretty sure someone at the Spanish administration can buy and install one of those, right?

Estonia, with its digital ID -that not only works, but it’s used by Estonian citizens-, its Smart ID, its e-Residency cards, and its whole governmental network, is years ahead of the game. I seriously can’t see Spain capable of deploying something similar in decades.

Make Things Easy For Your Citizens

This January, it was my 2nd wedding anniversary. To celebrate it, we took a week off at the Canary Islands. While I was there, I received an email from my accountant. I needed to upload a document that was missing. Also, I needed to pay VAT and taxes for the monthly statement. With the hustle of the preparations, I had forgotten about it.

Fortunately, I had my phone with me. My authorized representative had already prepared the payment operation at my LHV bank account. All I had to do was signing it with my mobile phone. Less than five minutes later, I had securely uploaded the documents and complied with my financial duties.

Now, that’s the future.

Conversely, comparing that to Spain, I was not even notified of the tax office alert -thus, the “alert” name is certainly misleading-. Not only I’ve never been able to understand my tax obligations and had to hire an accountant, but I also needed to spend quite a lot of time with her every month to make sure everything was (kind of) ok.

Now, they are asking me to pay taxes for an already closed company twice. All because of this big inefficient, fragmented and error-prone bureaucratic machinery.

Why You Should Open Your Company In Estonia If You Are A Solopreneur, Digital Nomad Or Freelancer

If you are from Spain, or everything I described above sounds like your country too, it’s time to consider if it’s the right place for you to do business.

Life is complex enough for us, freelancers and entrepreneurs, to add this kind of administrative nightmare. We just want to work, take care of our businesses and enjoy life. It’s that simple.

I left Spain, applied for e-Residency, and successfully opened a company in Estonia. In my view, that’s been one of the smartest moves of my life.

I can definitely recommend you to do the same. Imagine what you could do if, instead of struggling against your public institutions, they actually helped you make your life easier.

Conclusion

Today, I woke up with bitter news from the Spanish tax office. Another problem caused by the administrative mess that is the Spanish government.

Since I became an Estonian e-Resident, managing my Estonian company has proven so easy that I had completely forgotten about the Spanish way.

I felt inspired to write this post to emphasize some points where Spain, or probably many other countries, could learn from Estonia, allegedly the most digitally advanced society of our time.

It may sound naive, but I’m convinced that we can make things change if we let others become aware of how things could work. The technology is there. Let’s put it to work for us and build better societies together.

Comments ()