Payment Solutions For e-Residents, Solopreneurs & Small Businesses

One of the most critical decisions for every business is which platform to use to accept payments from your customers. However, for micropreneurs, getting a good payment solution is not always an easy task. Unfortunately, the situation gets worse for e-Residents owning a company in Estonia. In this article, I want to compare the available payment solutions for e-Residents and solopreneurs based on my experience.

If you are a freelancer and your customers pay you only when you issue an invoice, you are good to go. Nevertheless, if your business is a SaaS, subscription product, or you cannot rely on your customers to pay you on a regular basis, you need a good payment solution.

Note: although stressing alternatives for e-Residents, this article might be useful for most solopreneurs & small business owners. All you can read is based on my personal experiences unless stated otherwise. Obviously, yours might be different.

Your Payment Solution Is A Key Piece In Your Business

Quoting one of the most cited books on entrepreneurship, “The $100 Startup”:

“The basics of starting a business are very simple; you don’t need an MBA (keep the $60,000 tuition), venture capital, or even a detailed plan. You just need a product or service, a group of people willing to pay for it, and a way to get paid.”

One might think that accepting payments for your business should not be that hard. It’s 2018 after all, the year Elon Musk launched a car into space.

However, if you are a micropreneur or a small company, and especially if you need to accept recurring payments, it’s not easy at all.

Let’s say you decide to open a new business. You find a market, perhaps build an MVP or initial draft to solve the problem, publish a website to test the waters… And look for options to accept payments. Then is when you realize that this last part is going to be harder than you thought.

While it might seem like there are lots of alternatives out there for small businesses, the reality is quite different. If you, like me, are an e-Resident and own a company in Estonia, your options narrow down.

Why?

Challenges For Solopreneurs, Startups, And Freelancers

Most payment gateways want to deal with big companies. While I can understand that -big companies with high figures means big bucks for the middleman- that leaves small businesses in a precarious position. When you are starting, you cannot offer realistic profit estimates or sales forecasts. You are just starting.

That adds a lot of pressure to solopreneurs and freelancers. They often need to prove -or at least promise- enough sales for the payment gateway to consider you a “customer worth making business with”. And that’s ridiculous in 2018.

As far as I know, the resources you are using from a completely digital payment gateway, even if you don’t have any sales for months, are negligible. So why not letting that small business thrive and start generating revenue?

Additionally, for small business owners, most payment solutions present certain problems.

First, most of them require you to fill a series of legal documents and comply to sometimes obscure and hard to understand regulations. While it’s true that most micropreneurs and freelancers need to know something about managing a business, that stuff usually requires the help of a professional lawyer or economist.

In addition, many providers won’t allow you to withdraw your funds, or won’t send you your money, unless you exceed a certain revenue threshold. This is obviously to avoid fees for small transfers. Nonetheless, when you are a freelancer or solopreneur, you need your money every month, even if it’s just 150€.

Finally, some payment platforms send you the money with a significant delay. We are talking about 2-3 months here. That might be OK for medium to big companies, but it’s quite a significative time period for solopreneurs and freelancers.

Challenges For e-Residents And Estonian Companies

If you are an e-Resident owning a company in Estonia, the situation is actually worse. For starters, many payment solutions don’t support companies established in the Baltic countries. Up until recently, not even Stripe (one of the best, if not the best payment solutions out there) did.

Secondly, in my experience, the ones who support Baltic companies tend to be pickier when accepting them. Expect being requested a lot more information, and having to prove some revenue or potential customers.

Fortunately, there are at least some solutions out there that will not give you much trouble when setting up an account. Let’s talk about them.

Payment Solutions For e-Residents & Solopreneurs

So, what payment solutions for e-Residents and solopreneurs are available to your business? They all look perfect on paper. However, when you start working with them, you discover the small print, hidden fees, and other awkward surprises. So let me describe the ones I know or have used myself:

Paypal

It’s safe to assume that if you use Paypal, you are probably not happy about it. It’s one of these old companies that were a breakthrough back in their time, but haven’t managed to adapt since then (Amazon being another prime example). With everything that’s happening lately in the Fintech world and the myriad of alternatives out there, Paypal has simply become obsolete.

Another important problem is their fees. While they are not extremely high for large payments, they can be quite steep for small transfers. If you charge a small amount of money to a lot of customers -i.e: you offer online courses for 3 or 4 euros- the commission fee can be painfully high.

One thing that really gets on my nerves is that their fees are applied to the amount you received, not added on top of it. That means that if you request 100€ to a customer, Paypal will deduct their fee (around 3,20€) from that amount, so you will receive 96,80€. That makes it very difficult for you to know beforehand how much you need to ask your customer to pay you to get exactly the money you want.

That’s a nightmare for your accountant later.

Why have I included it here then? Because it’s relatively easy -compared to other services, anyway- to start operating with them, and it’s one of the very little viable payment solutions for e-Residents as of now.

So pros:

- easy onboarding and setup

- you can start operating right away

- not much paperwork to be “approved”

- recurrent payments

And cons:

- ancient, unintuitive interface with a front page make up

- high fees for small payments

- hard to issue an invoice for the exact amount you want to receive

- accountancy problems

- no API integration or mobile support (you need Braintree for that)

Stripe

Stripe is the best payment gateway in existence today. Full stop. Their API is so well built, it makes the “code is poetry” tagline, unfittingly coined by WordPress, become true. Their documentation is top-notch, and their web interface is so easy to use, you don’t need a technical background to use it.

Stripe has not been available for Estonian companies until very recently. They had a beta program for ages, and it seemed they would never open their platform to e-Residents. To get a sense of how badly people wanted Stripe to support Estonia, some folks applied the following hack to use Stripe. They would open their account pretending to have a company in one of the supported countries. Then they’d change their business and bank account details to receive the payments in their Estonian corporate accounts.

As Stripe did not support Estonia when I opened my company, and I did not want to mess with such an important part of my business, I’m using another payment gateway, Mollie. I’ll talk about them later in this article.

It does not matter if you are a developer, or someone else will be in charge of integrating Stripe into your system. You will not find an easier to implement or better documented platform. And that matters a lot. It can save you a lot of time and money.

So here are the pros of Stripe:

- Easy, paperwork-less setup

- Superb user interface

- You can start accepting payments quickly

- Ability to negotiate fees for high sales volumes

- Fast and smooth verification process

- Recurrent payments with lots of options (trial periods, discounts, promo codes…)

- Developer-friendly API, amazing documentation

And the cons:

- Their fees are a bit high

Braintree

Braintree is the payment solution I chose for my company, one of the little viable payment solutions for e-Residents. It was acquired by Paypal, but luckily they started as a startup, so have a fresh approach, similar to Stripe, a nice user interface, and a good, well-documented API.

Their fees are quite good, usually at 1,9% + 0,30€, with discounts when income starts exceeding 60k a year.

Their dashboard is not quite as simple to use as Stripe’s one, and the API is somewhat more complex and less developer friendly. However, I think it’s safe to affirm that you can start using it quite soon if you spend some time on it.

The main drawback for me is the approval process and requirements. Initially, you are allowed to open a sandbox account and start exploring the platform. Then, when you are ready to switch to production, you need to implement it on your website. And this website needs to be fully compliant with a lot of requisites. HTTPS, no broken links, terms & conditions clearly visible, etc.

Also, you need to fill different forms and hand over a lot of information about your business. It’s quite a nightmarish process. Eventually, you are subject to a trial and your application gets approved or rejected.

And this is the worst part… I know a lot of legitimate businesses from fellow e-Residents whose applications have been denied.

So all in all, pros:

- one of the best payment solutions for e-Residents if you get approved

- low fees on transactions (1,9€ + 0,30€)

- Decent API and documentation

- recurrent payments

- developer friendly

And cons:

- difficult onboarding and setup

- random account freezes, asking you to proceed to verification again

- paperwork and regulations

- approval process and uncertainty on whether your application will be approved or not

PaymentWall

Paymentwall is often discussed as one of the very few payment solutions for e-Residents available. However, my recommendation is: Stay away from them.

To begin with, they have an ugly, unintuitive interface that makes Paypal look nice and modern. Seriously, the first time you land on your PaymentWall dashboard, your first thought will be: “what the …. is this?”.

Next, their “due diligence” approval process is even more difficult to understand and comply with than the one from Braintree. The amount of paperwork, requisites, and forms you have to fill and research is overwhelming, and you would probably need help from a lawyer or an accountant.

On top of that, your business and website will be subject to a deep examination. You better not have a broken link on your website, fella!

So then you get “approved”. Yahoo!!!! Well… Not so fast. Initially, your customers won’t be allowed to pay with debit or credit cards. You will only have some options available like paying with the card from local grocery chains or from phone payment services. Needless to say, none of your customers is going to pay you a single buck.

No. You need to apply for card payments, and if you get approved (and only then) your customers will be able to actually pay you.

Apart from those problems, their fee system is not clear. They have hidden fees, and you will end up paying more than you expect, sometimes up to 10% or more. To make things worse, payments to your account are subject to a 2-months delay, and you will only get paid if your earnings exceed 100€.

Pros:

- One of the few payment solutions for e-Residents

- recurrent payments

And cons:

- unintuitive interface, seriously, ugly and unintuitive

- paperwork

- approval process

- hidden fees

- delays

- withdrawal threshold

EveryPay

EveryPay was another player in the payments arena that was acquired, in this case by LHV. When I initially contacted them to check if they were a good solution for my business, they didn’t accept recurring payments. Nevertheless, they recently implemented them. So, while I will write about them here, I don’t know about their services firsthand.

One of its most alluring aspects was that their integration with LHV. If your company is in Estonia, and you have your business bank account there, it’s worth having a look.

One red sign for me is the fact that they don’t clearly specify their pricing on their website. They say “1,2% to 3,5%”, and ask you to request a quote. I don’t know about you, but that does not give me good vibes. Sometimes, something as simple as being able to accept payments from your customers can become a negotiation to convince someone to accept your business and give you good conditions. I don’t think that’s fair.

Edit: after talking to the EveryPay/LHV staff, I got informed that my application would not succeed because my business is in a “high risk” activity area. Given that the activity of my company is programming and consulting (technology & business) services, I don’t see how this can be considered a high-risk activity (I mean, I am not in the porn or gambling industry ). Something to be aware of.

So without having used their services personally, my pros:

- integration with LHV

- one of the most friendly payment solutions for e-Residents

- recurrent payments

And my cons:

- unclear, obscure pricing, probably subject to negotiation

- weird classification of what is a “high risk” activity business

Paddle

Recommended by some readers of the blog, I had a look at Paddle. It seems like a very nice solution, and quite developer friendly. However, you soon realize there are important limitations to Paddle that restricts its usefulness in real-case scenarios (read: business).

To begin with, it’s only valid if you sell digital products, not for digital services. That means that if the main activity of your business is consulting services, for example, you cannot use Paddle.

But as I am a developer after all, and I have some apps in the App Store, I decided to give it a try. One of the most painful aspects of selling or offering products in the Apple’s App Store is Apple’s “In-App Purchase” system. It’s hard to use, program and maintain, quite obsolete, and takes a 30% cut on every sale.

I spent some time trying to integrate Paddle with one of my apps, 0Password, an app to keep your passwords secure through multiple devices protected by your biometric information (touch ID or faceID). It’s ideal for digital nomads and people like me who travel without a notebook containing all your passwords.

However, I was unable to do it. I contacted Paddle’s support team and they kindly explained that it can’t be used for iOS or Android apps.

So where does that leave us? If you only can use it for digital downloads or products (not services), and you cannot use it on mobile apps, probably it’s only useful for online shops or selling e-Books from a website. However, there are better and easier alternatives for those scenarios.

So pros:

- easy sign-up process

- nice dashboard interface

- not a lot of paperwork

And cons:

- not valid for digital services (like consulting), only digital products

- not valid for mobile apps

- very limited scenarios where you can use it

Overall, I can’t really recommend Paddle. Except in very very limited scenarios, it’s not very useful for real e-Resident businesses.

Mollie

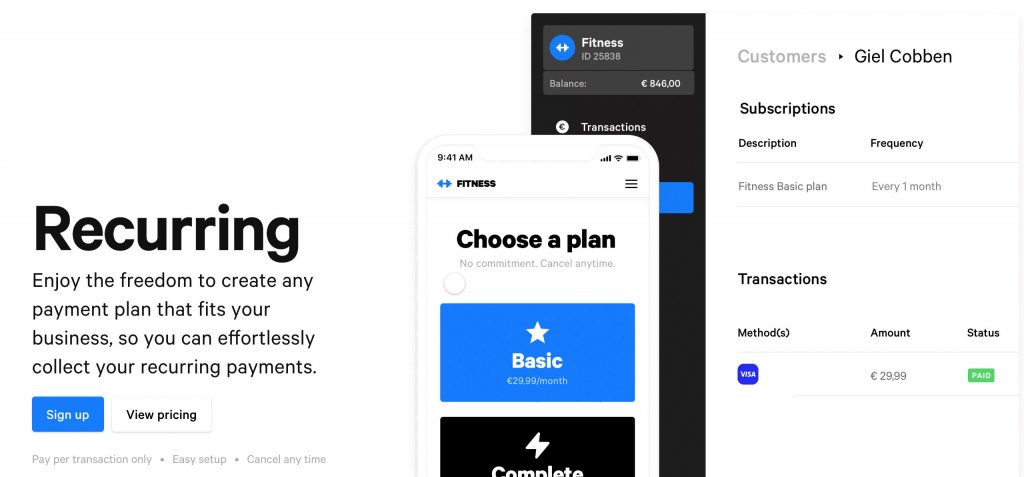

Also suggested by one of the commenters, I tried Mollie. It’s a French company offering a very competitive solution. In fact, it’s the payment solution I’m using right now for Companio.

To begin with, the verification process is fast and simple. Not a lot of paperwork. Just handing over some information and uploading some documents of your company (like the entry of the registry and the articles of association) and yourself (like a picture of your ID).

Some e-Residents have reported that their businesses have been rejected due to the fact that they are e-Residents, but honestly, I let them know I was an e-Resident from the very beginning and had no problems with them whatsoever.

They have a lot of useful payment methods, such as VISA and Mastercard card payment, or direct transfers. Their pricing is quite good too. For example, card payment for European customers/cards is just 0,25€ + 1,8%.

Apart from Stripe, Mollie is the payment gateway I’ve been using more, so I can tell describe their pros and cons in more detail.

Obvious pros are, as I mentioned, the uncomplicated verification process, and the fact that you can enable real payment methods right from the start, like debit card payments or SEPA direct debit.

Now about the cons. Their API is not as good as Stripe’s one. Not just because it’s not documented and easy to use, but also because it seems it has not been designed with real-life scenarios in mind.

One example is how recurrent payments and payment links work. Unlike other payment solutions, you can’t just send a payment link to your customers using Mollie’s API. The payment link will expire in 15 minutes.

Unless your customer is checking the inbox folder like a maniac and waiting for the link to pay you, that’s a terrible waste of time. You need to build a custom payment invitation system that will generate the payment link on demand when the user is about to click on it. That’s a lot of work and defeats the purpose of payment links.

Another example is adding debit cards to your customers. Most other payment gateways allow you to collect the debit card information from the user without making a payment. That’s super useful when the card has expired or the customer lost it and needs to add a new one.

In Mollie, you can only do that if you generate a new payment for the customer, so at least they will need to pay 0,01€ to add a debit card. It’s not that much, but from the point of view of the customer, you are charging them for allowing them to pay you with their debit card.

Another problem is that you need to rely on the API to do almost everything. They have a dashboard where you can send a payment link, but they will charge you an extra for things like payment reminders, that other providers (such as Stripe) offer for free.

You cannot use the dashboard to create customers or recurrent payments either. You need to do all of that through the API. That means that, unless you are a developer or have a good development team, you will only be able to access a very limited set of functions of what Mollie can offer.

The pros:

- easy onboarding, nice and simple user interface

- payment methods are enabled soon (a couple of days tops, including debit card payments)

- almost no paperwork to be verified

- decent API and documentation, though not as good as others

And the cons:

- an extra cost for basic functionality such as payment link reminders

- poorly designed API for real use case scenarios

- no recurring payments from the dashboard either, only through the API

- some e-Residents report that their companies have been rejected because they’ve been founded by e-Residents

The Winner?

Now that Stripe supports Estonian companies, go for it. It’s the best payment gateway out there. Without a doubt. If you don’t like Stripe, and are a proficient developer, try Mollie. Expect some hard work to get everything ready.

Most other payment gateways described in this article are way worse than these two.

I will update the article if/when needed.

Am I Missing Something?

If you have experience with other payment gateways or payment solutions for e-Residents, solopreneurs or micropreneurs, leave a comment below. Alternatively, you can contact me and tell me about your experience in more detail. I promise to update this post with your information. Thank you!

Conclusion

Your payment platform is one of the most important decisions you need to make for your business. In this article, I share with you my experience with different payment solutions for e-Residents and solopreneurs.

Comments ()