Why losing 130,000€ made me the happiest man alive (Part 3)

Welcome to the third (and final!) part of the post series “Why losing 130,000€ made me the happiest man alive”! For those of you who missed the first and second parts, in these articles I describe how I amended the biggest mistake of my youth (buying a house).

I have been criticized for selling the house. Most people told me I should have hung on to it. In this episode, I describe the final part of the process, closing the bank account, and analyze the total outcome of buying a house when I did and selling it (those whooping 130,000€ in losses). I also argue (and support my argument with numbers) that selling now was the right decision (I should have, indeed, sold it sooner. The only problem was, of course, that I had no money to cancel the mortgage).

Closing the Spanish bank account?

But first things first. The bank account. As you know, I hired a lawyer to help me with the sale. He was also in charge of closing the bank account once everything had ended. The Power Of Attorney I signed, which I was said was more powerful than Superman on steroids, allowed him to do that.

Closing a bank account is easy, right? You go to the bank (in this case, the lawyer and his PoA) and just ask for the account to be closed.

Well, unfortunately not. As part of the process of selling the house as a non-resident in Spain (which I haven’t been since 2017), I had to pay 2100 euros to the buyer of the house. Then the buyer (and not me, for a weird reason I don’t understand) has up to two months to deposit this amount of money into a Tax Office’s account. After those two months, and only then, you are allowed to claim back that money, submitting a series of reports stating that I lost money when I sold the house (compared to the original sale price), and so as a non-resident, I am eligible for a refund.

This process, apparently simple complex, it’s made even more complex due to the presence of several middlemen (including the buyer’s bank, a notary, etc).

What does any of these has to do with closing the bank account? Well, the tax office can only refund you this money to a Spanish bank account you own. So the account cannot be closed until then.

Why selling now?

“Please, don’t sell it now, I know it is a bothering for you, but hang on to it a little longer”, “A house is ALWAYS a safe investment in the long run”, “Don’t mis-sell it, you will lose a lot of money”, and “Are you out of your mind? Where will you go back to once you get tired of your nomadic adventures?” were the most common comments I heard when I mentioned that I was planning to sell my house.

I cannot blame my family and friends, they want the best for me, and most don’t understand my lifestyle. Not having a house is not freedom, but living on the edge of an abyss for them. On top of that, they haven’t gone through the process of having this house as a useless weight over their shoulders for years like I did.

But most importantly, they are also immersed in the Spanish culture of “renting is throwing money down the drain“. They can’t understand that selling the house now, assuming the losses soon, and putting your money to work is better than continuing paying the mortgage only to end up with a useless real-estate liability.

Asset, or liability?

A house can be an asset or a liability. Even if you don’t want to live there, keeping an asset may be an intelligent decision.

Before we can analyze if selling was the right decision or not, it’s only fair that you know more about the apartment. My flat was in Molina de Segura, a village in Murcia, a small region in the South-East of Spain.

Molina de Segura is not in the coast. It has nothing special, it’s just an ugly small agrarian Spanish village. Simply put, there’s nothing there. Nothing to do, nothing to see, no cultural or underground scene, no nature, forests, or lakes around, no events, no interesting stuff going on. There are some bars and restaurants, and a couple of spas nearby (in the neighboring towns of Totana and Archena), and that’s all. No offense intended to the town or it’s inhabitants, of course. But the most exciting thing you can experience there is visiting the same medieval market every year or going to the concert of a B-series “Spain’s got talent” artist.

Why did I buy that house? Well, as you may have imagined by reading the other posts, I was young and inexperienced stupid. Besides, it is very close to the university, I could afford it, and I thought my life will revolve around the university back then.

If it was on the coast, it would have been ok. Even if I don’t want to live there ever, I would have been able to rent it for holidays or put it on Airbnb for a reasonable(-ish) price. As I explain in the first episode of the series, the number of houses in Murcia quintupled in ten years between 1997 and 2007. Simply put, there were loads of empty houses, and nobody to buy them. There were indeed more houses than people, and rental prices were as low as 200-250€ on average in my area (the city center). My monthly expenses were 650 euros, so renting it wouldn’t have even covered half of them.

So the worst thing was, I was not living there, but I was paying 650€ every month to maintain that house in the hopes of finding a tenant. The two times I succeeded, I had trouble. One of the lessees stopped paying at a certain point. The other left almost 800€ in debt with the local water and electricity companies.

There is no better definition of a liability that I can think of.

Why selling was the best decision from a personal perspective

With that grim scenario, you can understand why that house was making my life miserable. It was a constant reminder of my mistakes, and how stupid I had been during my youth. For every problem there (a pipe would break, the roof would need to be repaired after a storm, etc) I had to ask for help from my parents. They live 50 km away, on the coast, and are in their 60s. Traveling through the truck-infested road that separates both cities is not a happy way of spending a Friday afternoon for them.

Sometimes, I would wake up in the middle of the night, completely freaked out about a problem with the apartment. At the beginning of our travels, when my business was still in its early stages, those extra 650€ a month were an amount I could not afford to lose every month, so I was still moonlighting as a freelancer. This brought a lot of stress to my life.

Emotionally, psychologically, spiritually, I needed to get rid of that house.

Why selling was the best decision from a financial point of view

Now let’s analyze the numbers to see if it also made sense to sell my house or I was being impulsive and irrational. I will try to demonstrate that it was the right decision.

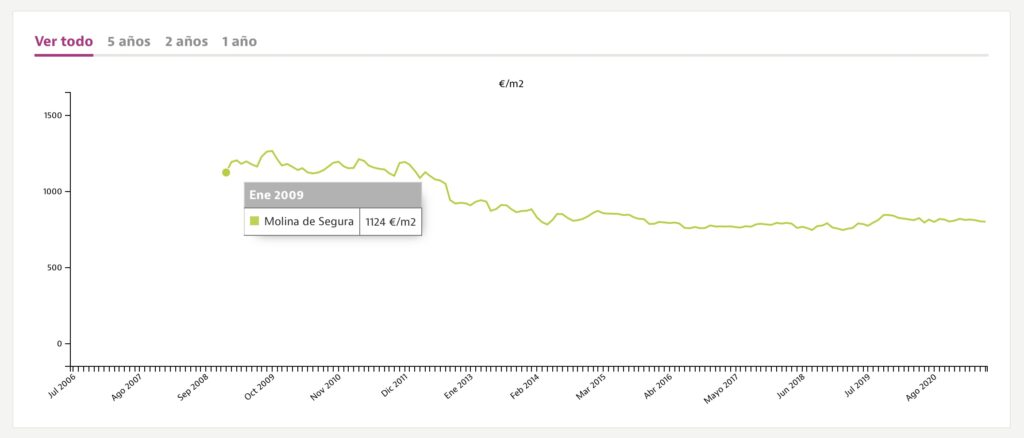

First, it is important to analyze the evolution of prices in Molina de Segura. Unfortunately, there are no records before Jan 2009, but given that the real state bubble exploded in 2008, we can assume that the prices in 2009 were, at least, lower than one-two years before.

The graph above shows the evolution of prices in a 12 years period. Contrary to popular belief (“house prices always go up!!!”), the price per square meter has been declining since the real estate bubble exploded and shows no signs of recovery (as of Jun 2021, it is 801€/m2, 320€/m2 less than at the beginning of 2009).

My mortgage would have matured in March 2037 😱. That means that I had almost 20 years left of payments until I was able to cancel it. If this graph tells us anything, is that prices were not expected to go up substantially, not at least to consider that an “investment” at all.

What about the selling costs?

Well, everybody wants a piece of the pie! If you have a house and want to sell it, there is a system in place to bleed you with a myriad of (not-so) small costs, fees, and taxes.

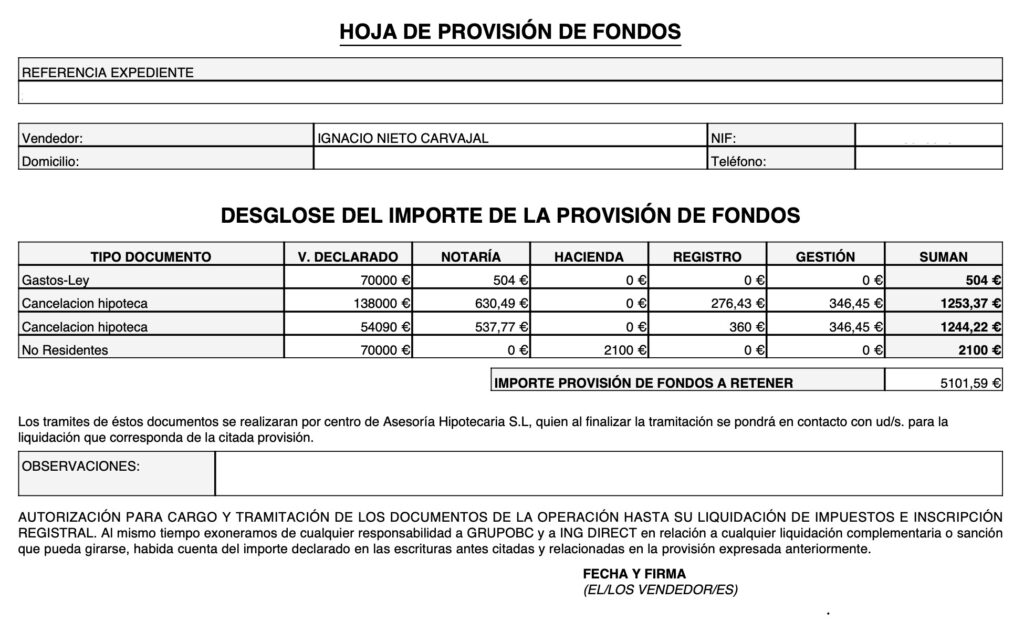

Soon after listing the house, I learned that it was not enough to cancel the mortgage at the bank. You also need to cancel it “in the registry”. To my surprise, when we tried to do it, we realized the previous owner of the house had not canceled his old mortgage. That, in theory, is impossible. I bought the house “unencumbered” and “free of charges” (that’s at least what my notary assured). But no matter how much I denied reality or thought about suing my notary. The fact was, I had to cancel both mortgages in the registry if I wanted to sell the house.

As I have mentioned, closing the bank account was also a problem, and required the payment of 2100€ to the tax authorities without any guarantee of recovery.

But there were many other costs, from the real-estate agency fees to an “energetic efficiency certificate“. Let me enumerate most of them:

- The tax office pre-payment: 2100€

- Real estate agency costs: 2100€ (3%, without VAT if it was paid “in hand”, because yeah, it’s Spain…)

- Mortgage “cancelation” fees x2 (mine and the previous owner’s one): 3001.59€ (5101.59€ with the non-resident tax office pre-payment)

- Lawyer costs: 640€ + VAT

- notary fees: 424.30€

- Power of Attorney costs: 52.10€

- energetic efficiency certificate: 130€

- cancelation of utility bills, internet, town hall fees, etc: 1482.50€

Bringing everything together, it’s slightly over 10,000€, more than 14% of the sale’s value.

Just for the record: I have left some expenses out, such as the IBI payment (an annual tax fee house owners have to pay) or the 21€/mo that my bank was charging me to keep the account open.

Mr. Von Count, can you help us, please?

Ho ho ho! With pleasure!

So the mortgage was initially 138,000€. Thirteen years after making the biggest mistake of my life, I was able to amend it, build a profitable business, and receive 95k euros in dividends, enough to pay the remaining mortgage, 95,137€ at the time.

I sold my house for 70,000€, minus expenses, fees, and costs, my profit went down to just 60k euros.

Considering only the money I invested (95,000€) and the money I’ve got (60,000€), my losses were just 35,000€. But that’s only half of the story. You have to account for the money I’ve lost during all these years. Up till the day I canceled the mortgage, I had paid 650€ for 159 months, totaling 102,700€.

I was able to rent the house for some months, but the benefits, as I mentioned, were meager (circa 6600€ total). That gives us a final result of 60,000€ – 102,700€ – 95,000€ + 6600€ = -131,100€ in losses.

I have even considered tattooing that amount in my right arm, shall I ever think about buying a house again.

What if I had not sold the house?

Let’s imagine for a moment that I follow the advice of my family and friends in Spain and keep the house to avoid “misselling it”. Let’s do the numbers:

- In that case, I wouldn’t have paid those 95,000€ in dividends and gotten 60,000€ for the sale of the house.

- I would have had to pay the mortgage installments for 190 months more. Supposing an average of 650€/mo, with no major fluctuations in interest rate, Euribor index, etc, that would mean 190×650€ = 123,500€ more.

- So the final amount would be: the value of the house -102,700€ -123,500€ = the value of the house – 226,200€.

In the end, I would end up with an apartment that…

- … probably has not gained much in valuation. As you saw in the graph above, prices in Molina de Segura have stagnated (or are even declining), and there’s no indication that they will go significantly up. Not at least, to cover for 226,200€ in losses.

- … is in a place I don’t ever want to live, ever.

- … is in a place where the median rental price is around 200€/mo, which means it is a bad bad investment if you intend to rent it.

On top of that, you have to account for inflation. In conclusion, a house in Madrid or Barcelona may be an asset, but in Molina de Segura, it’s just a liability.

Investing that money instead

So what if I assume the losses and put the little money I get back to work instead? That’s what I did. I invested it. I am getting an average annual ROI of 10.49%. That’s 524,5€/mo without considering compound interest. Of course, if you account for compound interest, things get even more profitable.

But let’s just imagine that, instead of losing 650€ every month for another 190 months, I actually gain 524,5€. That’s 1174.5€ more in my pocket every single month.

If you consider that amount I would have lost during those 190 months (123,500€) and compare it with gaining 524,5€ for 190 months (99,655€), that’s a difference of 223,155€. With that amount, I can buy a much better house in a beautiful place, on the coast, probably even in a European capital, and maybe even one that’s an asset (can be rented, or it’s in a place that will increase its value).

So, was selling now a good decision from a financial point of view? I think I have proven that the answer is a resounding YES.

Conclusion and lessons learned

Well, all this experience has shown me a valuable lesson or two. First, don’t own a house. Really. I know I am being quite extreme here, but there are so many voices screaming in the other direction, that I think I need to be very opinionated.

Don’t let the noise of others deafen you. Most people are financially illiterate, and even in the US, Canada, or the whole European Union, live paycheck by paycheck. Harsh as it sounds, most folks out there are like parrots, repeating the same old tired dogmas that made sense in the post-war period (1950-1980), but not necessarily anymore. Renting is not throwing money down the drain. You don’t need to own a house. It is not a safe investment. It’s not guaranteed to always go up. There are much better ways of investing your money, and much more affordable, easy, and free ways of living without owning a house.

Of course, it is ok to own one, but if you do, make sure you are acquiring an asset, not a liability.

Also, if everybody’s doing something, it’s a bad investment, or the moment to do it has passed. As Benjamin Graham always claimed, when everyone is talking about a company, a stock, or a new investment channel, it’s because it’s already overpriced. If your neighbor is talking about investing in bitcoin, you know the time to invest has passed. It may be the time to cash out.

But overall, if I can only convey a message with this post, is the following: don’t enter the system unless you know you want to play by its rules. Getting out once you are a digital nomad is hard, so do things right from the start.

Understand what buying a house really means. What you are sacrificing, what you are committing to, what you are losing in terms of freedom. Put your freedom on a balance, and decide if you really want to take the blue pill. Don’t open a bank account in a traditional bank if you can avoid it. If you already have one, switch to an online banking solution. Read, study, educate yourself, become financially literate. If I had known the terrible mistake I was about to make in my late 20s, I would have saved myself a lot of trouble, stress, and money.

The moment I received that email from my lawyer informing me that the house was sold was one of the happiest ones of my life. It freed me from a yoke I have been wearing for a very, very long time.

Comments ()