Banks Are Going To Disappear. Here's Why.

For quite some time now, I am a happy fintech customer. For my personal finances, I use Revolut. For my company, I use Holvi. The other day, I had to visit an office of the bank where I keep the only traditional bank account I’ve not been able to close yet. I needed to get new credentials and a “signature” number to be able to operate with my money. almost an hour later, I left the bank with just one thought in my mind: “Banks are going to disappear”.

Here’s why.

Video Kill The Radio Star…

Get into a church in Spain, and you’ll notice there are -mostly- only old people. Young people -with rare exceptions- don’t go there anymore, even if they believe in God. Why? Because the church has slowly but steadily disconnected from reality. They have alienated themselves from society by refusing to adapt to its changes. Probably in 20 years, churches will be empty in Spain, or most of them will close.

The same will happen to the TV. Less and less teenagers watch TV. They have Netflix. Why? Because they want to choose what they watch, and they can’t stand those lame ads anymore. I don’t own a TV, but a lot of people from my generation still do. Hence, it’s going to take longer for it to disappear. But it will eventually disappear. Video killed the radio star, and Netflix killed the TV…

As I explained in this article, this technological disruption has reached the banks. In my case, I was painfully aware of that as soon as I left my home country.

Once I became a digital nomad, it soon became obvious that banks don’t like people who travel regularly without a home country. These institutions are rooted in the past. They existed before the internet, even before computers existed. They are conservative institutions that are, for the most part, reluctant to change.

That’s the main reason why fintech solutions took them by surprise. While banks were struggling, trying to build decent web interfaces their customers could use without ending up frustrated -without much success-, Revolut, N26, and others created a solution that was simply superior. Just like Uber or Airbnb did in their respective fields.

My Last Traditional Bank Account

When I got out of college, I didn’t want to work in a cubicle. Not that I had many alternatives.

I was born and raised in Murcia, a small region in the South-East of Spain. I never heard the word “entrepreneur” during my childhood or boyhood and, of course, neither at the University. I was taught to be the best developer in order to be hired by a big software consultancy agency where I would spend 40 years of my life if I was lucky.

So when I graduated, I decided to stay at the University and work as a researcher as an alternative. I was a product of my education and environment back then, and I followed the outlined path. I started working in a job that I didn’t love, but was the “lesser evil”. After some time, I bought a house and acquired a mortgage. Of course, that included a bank account.

Fortunately, you are never too old to change your life. I eventually moved to Madrid to work in a cubicle for years, left the cubicle, became a freelance first, an entrepreneur next, and a digital nomad last.

However, that bank account, linked to my mortgage, was always there, like a bleak reminder of the bad choices from my past. That bank -Cajamurcia- was acquired by another bank -BMN- and, some years later, that one was also acquired by another one -Bankia-.

Losing Hope

Even though I didn’t have any debit or credit card with that bank, and I had my mortgage there, I was paying maintenance fees.

At first, I was kind of outraged. I would ask the bank to cancel them, and they would do that… for a couple of months. Then they will start charging them again. Then I moved from Murcia to Madrid, and I could no longer go to “my office” to talk to the director and ask him about the fees. I tried some phone calls for a time, but that’s not something you can do forever. Eventually, I resigned and assumed they were stealing a small amount of money from me every month.

Then, at a certain point, I lost my coordinates card. In case you don’t know what those are, it’s an old system that banks used to secure online operations. If you wanted to do a bank transfer, for example, you would be asked one of the numbers in this coordinates card.

As I was not operating with this account -I just made sure to transfer the money for the mortgage every month there- and because getting a new one would involve doing a trip to Murcia and visiting a specific bank office, I let it go. Perhaps not the wisest decision ever, but I wanted as little interaction with this bank as possible.

After being acquired and re-acquired, the coordinates system was replaced by a “signature” (i.e: a numeric passcode), and I was no longer able to even enter my account.

My Visit To The Bank

Fast forward to September 2018. Madrid, Spain.

Yesterday I went to the bank to get my credentials and the “signature”. This magical number that will allow me to operate with my own bank through the app or web.

Because… Even if it’s 2018, that number can only be obtained through a physical visit to the bank’s office.

We are spending a few days in Madrid. We came here because my parents will marry again soon. I think they call that a Ruby Wedding. In the case of my parents, it’s just a celebration of life and love after my mother has survived breast cancer.

Anyway, I had this buzz in my hear telling me that I needed to visit a bank office. So when we passed along a Bankia office, I decided to get in and try to get the signature. I thought it may take me a couple of minutes, maybe half an hour.

But This Is Not Your Office…

After a short wait, I was greeted by the representative of the office. I explained her the whole story: that I had an account with bank A, but it had been acquired by bank B, and later bank C, so I needed my credentials and the signature number.

So after 5 minutes of clickety-clackety, she told me that “my office” was in Murcia, so I needed to go there to get my credentials and signature.

What? You must be joking right? I mean, I’m in an office of my bank, and you are asking me to travel 600km down south just to be able to use my bank account?

Yep, that’s right sir.

It took a while to convince her, with a very stoic attitude, that I won’t be leaving that office without being able to access and operate with my account.

Then the red tape dance began. In order to generate my credentials, I needed to sign a document and she needed to print it and give it to me. As the app was crashing and for some weird reason the credentials didn’t work properly, we went through this process 4-5 times. Then the same happened again with the signature, only that every time she regenerated this signature, we also needed to change the credentials… And of course, sign a new document and give me a new printed copy.

This went on for about 45 minutes. Finally, after a series of frustrated attempts, we were able to get both the credentials and the signature working. During the whole process, this lady was obviously eager to get rid of me, repeating over and over that she needed to serve other customers. I left the place with 20 pages in my hand and thinking about the whole banking experience.

Why Banks Are Going To Disappear

My experience is just a small example of why banks are going to disappear. The world has changed, but they have failed to adapt to the new times. And in my humble opinion, they never will. Just like taxi drivers keep on protesting because of Uber, but they do nothing to fix what’s wrong with their business model and the terrible service they provide.

These are some of the problems they are failing to solve for their customers.

Location Independence

I never went to a bank office with a briefcase full of cash to deposit my salary. My money is nothing more than a sequence of zeroes and ones stored somewhere in the depths of a corporate network. In a time when we can pay with our smartwatches, bills are quickly becoming an anachronism.

And yet, I still have to visit a bank’s office to do some stuff. If you are a digital nomad, traveling to your home country to just get a document or sign something may simply not be an option.

To make things worse, in some countries -like mine- you not only need to go to your bank, but to go to …

… Your Office

If I open a bank account, I expect to be able to get the same service in all of their offices. Instead, banks -at least in Spain- have this concept of “your office”. And it’s in that office -and only in that office- where you can do certain things, like change your maintenance fees or discuss the conditions of your mortgage.

I think this has to do with the fact that you are supposed to have this relationship with your office’s director. This person that allegedly knows you well since you were a child, and trusts you, so they get to decide if they grant you a loan or not…

Apart from the fact that this introduces an arbitrary element into the equation -I should be granted a loan based on my financial background, not on how much the director likes me-, this ignores the fact that people don’t live in their home village for their entire life anymore. You can change your personal office anytime, yes, but what’s the whole point of having one?

Technology

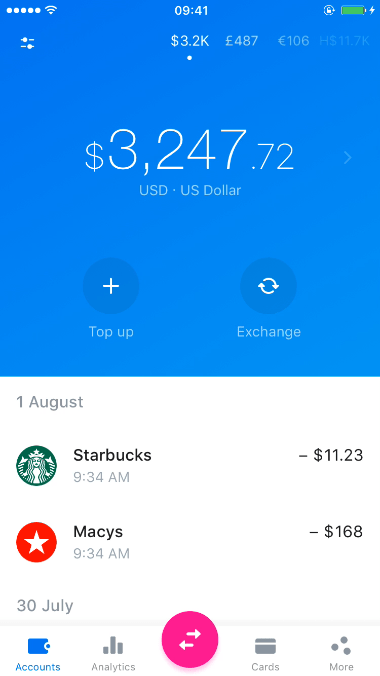

While the mobile app of my bank kept on crashing when attempting to access with my credentials, I could only think about the Revolut app.

While the mobile app of my bank kept on crashing when attempting to access with my credentials, I could only think about the Revolut app.

It’s not just how easy everything is, or the fact that you can operate completely online. It’s the whole new banking experience. It’s how you can transfer 10€ to a friend to pay for the pizzas instantly, or how you can arrive at a new country and open an account for the local currency in a matter of seconds.

It’s how you can create a virtual card that you can use just for one specific thing. I use one for the gym and delete it when I cancel my subscription. Or how you can create disposable cards instantly to do a one-time payment on the internet more securely…

It’s how Revolut, Monaco, and others are integrating cryptocurrencies in our finances smoothly and seamlessly. Or how my digital bank includes travel insurance, or offers me useful services instead of junk bonds…

Banks simply can’t compete with that.

Transparent fees

Fees are another important problem of traditional banks. Not the fact that they charge you fees, but the fact that they are seemingly arbitrary and opaque. I’ve been charged fees for years in my bank. I had no card. My mortgage was there, and there was a regular income entering every month.

Still, my bank kept on charging me fees. Sometimes they won’t recognize the income as a “proper salary”. Other times, they will agree to remove the fees, only to apply them again two months later. Every time, I needed to go to “my bank’s office” to discuss the topic with the director. Obviously, as soon as I started traveling, that became impossible.

What’s worse, if you are friends with the director of your office, this person can remove those fees based on completely subjective terms.

All this just feels so wrong these days. We have grown used to services with clear, transparent pricing and terms of use. It’s only natural that we demand the same level of professionalism from the companies that keep our money.

The Younger Generations Just Don’t Buy It Anymore

Millennials don’t trust banks. Their mindset is different. They don’t want to own a big house and a big car, marry, have children, and spend 40 years of their life working in a cubicle to pay all that. They are not buying that fake dream the rest of us bought.

They want things simple, easy and transparent. They know technology can offer them solutions. And more importantly, they are convinced that they can change what has been previously considered sacred. That’s bad news for institutions such as banks.

It’s going to take some time. Just like old people still go to church on Sundays, just like most of my generation still watches TV… But it will change. I wouldn’t dare to say “banks will disappear in 20 years”, or “banks will disappear in 50 years”… But the writing is on the wall.

Fintech Solutions

If you want to know more about available fintech solutions for your personal finances, I wrote about them in this article. Even though initially aimed at digital nomads, I think it may be useful for everyone nowadays.

Also, if you are looking for a digital banking solution for your company, there are amazing fintech options out there. I talk about them in this article.

Why? Because I think they are the future, and they make our lives simpler and easier.

Conclusion

After an awkward -but somewhat comical- visit to my bank’s office, I decided to write a post about why banks are going to disappear. It may not be tomorrow, or next week, and definitely not next year. But their time has passed. They have failed to adapt to the digital banking revolution, and this fact has been exploited by an ever-growing number of fintechs. They are the future of banking.

Comments ()